Here's Why We Think Vertoz Advertising (NSE:VERTOZ) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Vertoz Advertising (NSE:VERTOZ). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Vertoz Advertising

Vertoz Advertising's Improving Profits

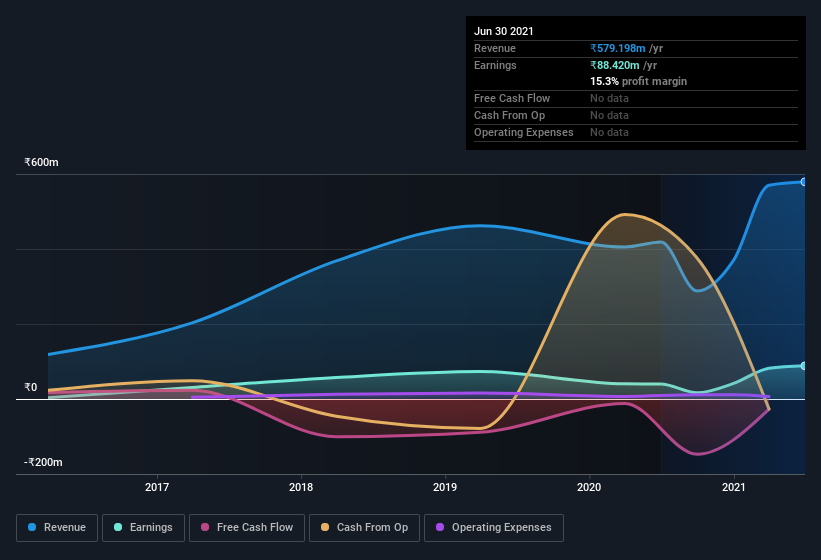

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Like the last firework on New Year's Eve accelerating into the sky, Vertoz Advertising's EPS shot from ₹2.94 to ₹7.39, over the last year. You don't see 151% year-on-year growth like that, very often. The best case scenario? That the business has hit a true inflection point.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that Vertoz Advertising is growing revenues, and EBIT margins improved by 5.8 percentage points to 16%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Vertoz Advertising is no giant, with a market capitalization of ₹1.3b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Vertoz Advertising Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that Vertoz Advertising insiders netted -₹500k worth of shares over the last year. But the silver lining to that cloud is that Rohit Vaghadia, the Non-Executive Independent Director, spent ₹2.0m buying shares at an average price of ₹257. So, on balance, that's positive.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Vertoz Advertising insiders own more than a third of the company. In fact, they own 63% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Valued at only ₹1.3b Vertoz Advertising is really small for a listed company. That means insiders only have ₹847m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

Does Vertoz Advertising Deserve A Spot On Your Watchlist?

Vertoz Advertising's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Vertoz Advertising belongs on the top of your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Vertoz Advertising , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Vertoz Advertising, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Vertoz, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:VERTOZ

Vertoz

Engages in the programmatic advertising business in India and internationally.

Flawless balance sheet with acceptable track record.