- India

- /

- Interactive Media and Services

- /

- NSEI:MATRIMONY

Matrimony.com (NSE:MATRIMONY) Is Due To Pay A Dividend Of ₹5.00

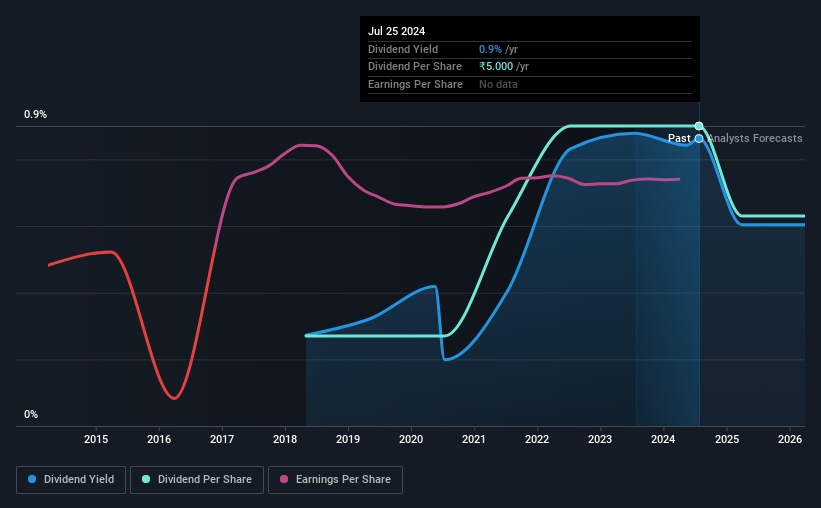

The board of Matrimony.com Limited (NSE:MATRIMONY) has announced that it will pay a dividend of ₹5.00 per share on the 8th of September. This makes the dividend yield 0.9%, which will augment investor returns quite nicely.

See our latest analysis for Matrimony.com

Matrimony.com's Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. However, Matrimony.com's earnings easily cover the dividend. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS is forecast to expand by 52.1%. If the dividend continues on this path, the payout ratio could be 18% by next year, which we think can be pretty sustainable going forward.

Matrimony.com Is Still Building Its Track Record

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. The dividend has gone from an annual total of ₹1.50 in 2018 to the most recent total annual payment of ₹5.00. This means that it has been growing its distributions at 22% per annum over that time. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

Matrimony.com May Find It Hard To Grow The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, Matrimony.com has only grown its earnings per share at 3.6% per annum over the past five years. If Matrimony.com is struggling to find viable investments, it always has the option to increase its payout ratio to pay more to shareholders.

In Summary

In summary, we are pleased with the dividend remaining consistent, and we think there is a good chance of this continuing in the future. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Matrimony.com that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MATRIMONY

Matrimony.com

A consumer internet company, provides online matchmaking services on internet and mobile platforms in India and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026