- India

- /

- Entertainment

- /

- NSEI:INOXLEISUR

What Does The Future Hold For INOX Leisure Limited (NSE:INOXLEISUR)? These Analysts Have Been Cutting Their Estimates

The latest analyst coverage could presage a bad day for INOX Leisure Limited (NSE:INOXLEISUR), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative. The stock price has risen 4.4% to ₹341 over the past week. We'd be curious to see if the downgrade is enough to reverse investor sentiment on the business.

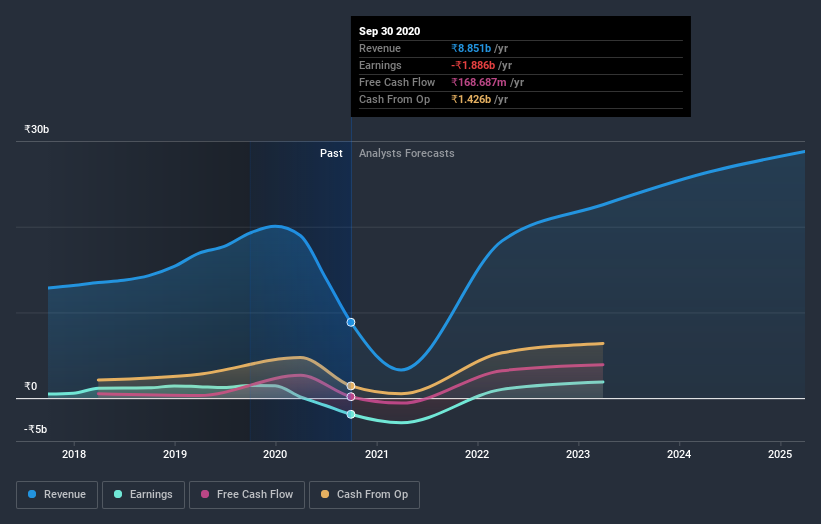

After the downgrade, the consensus from INOX Leisure's ten analysts is for revenues of ₹3.3b in 2021, which would reflect a concerning 63% decline in sales compared to the last year of performance. Per-share losses are expected to explode, reaching ₹27.47 per share. Yet before this consensus update, the analysts had been forecasting revenues of ₹4.0b and losses of ₹27.17 per share in 2021. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also making no real change to the loss per share numbers.

Check out our latest analysis for INOX Leisure

The consensus price target was broadly unchanged at ₹347, implying that the business is performing roughly in line with expectations, despite a downwards adjustment to forecast sales this year. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic INOX Leisure analyst has a price target of ₹451 per share, while the most pessimistic values it at ₹249. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast revenue decline of 63%, a significant reduction from annual growth of 6.1% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 13% annually for the foreseeable future. It's pretty clear that INOX Leisure's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on INOX Leisure after today.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for INOX Leisure going out to 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade INOX Leisure, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:INOXLEISUR

INOX Leisure

INOX Leisure Limited operates and manages multiplexes and cinema theatres under the INOX brand name in India.

High growth potential and fair value.

Market Insights

Community Narratives