David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that HT Media Limited (NSE:HTMEDIA) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for HT Media

How Much Debt Does HT Media Carry?

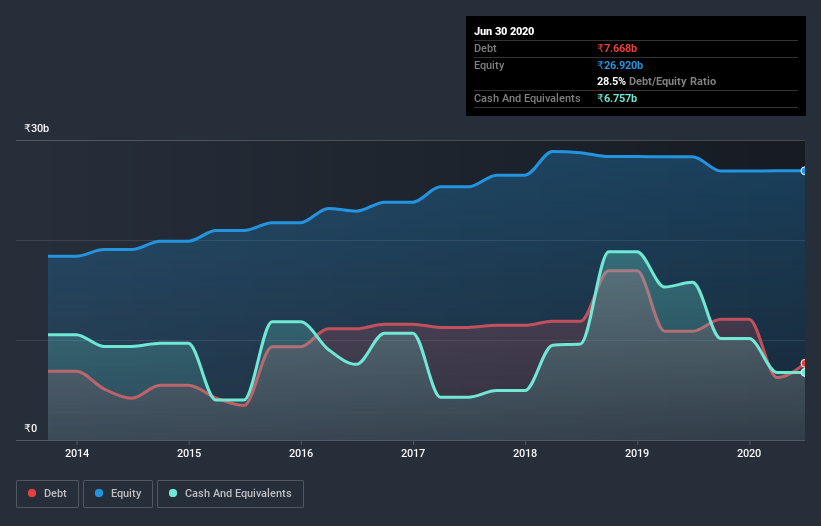

As you can see below, HT Media had ₹6.24b of debt at March 2020, down from ₹10.9b a year prior. However, it does have ₹6.76b in cash offsetting this, leading to net cash of ₹512.9m.

How Strong Is HT Media's Balance Sheet?

According to the last reported balance sheet, HT Media had liabilities of ₹14.9b due within 12 months, and liabilities of ₹3.21b due beyond 12 months. Offsetting this, it had ₹6.76b in cash and ₹4.42b in receivables that were due within 12 months. So it has liabilities totalling ₹6.9b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the ₹2.87b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, HT Media would likely require a major re-capitalisation if it had to pay its creditors today. Given that HT Media has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine HT Media's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year HT Media had negative earnings before interest and tax, and actually shrunk its revenue by 21%, to ₹17b. That makes us nervous, to say the least.

So How Risky Is HT Media?

Although HT Media had negative earnings before interest and tax (EBIT) over the last twelve months, it generated positive free cash flow of ₹394m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. Given the lack of transparency around future revenue (and cashflow), we're nervous about this one, until it makes its first big sales. To us, it is a high risk play. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with HT Media , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade HT Media, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HT Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:HTMEDIA

HT Media

Engages in the printing and publication of newspapers and periodicals in India.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in