How Does Entertainment Network (India)'s (NSE:ENIL) CEO Pay Compare With Company Performance?

This article will reflect on the compensation paid to Prashant Panday who has served as CEO of Entertainment Network (India) Limited (NSE:ENIL) since 2007. This analysis will also assess whether Entertainment Network (India) pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Entertainment Network (India)

Comparing Entertainment Network (India) Limited's CEO Compensation With the industry

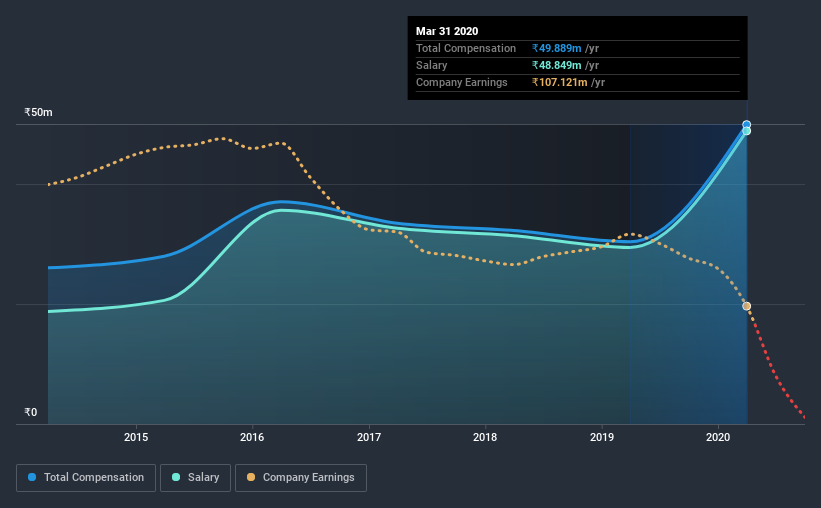

At the time of writing, our data shows that Entertainment Network (India) Limited has a market capitalization of ₹7.6b, and reported total annual CEO compensation of ₹50m for the year to March 2020. We note that's an increase of 64% above last year. Notably, the salary which is ₹48.8m, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below ₹15b, we found that the median total CEO compensation was ₹14m. This suggests that Prashant Panday is paid more than the median for the industry. Moreover, Prashant Panday also holds ₹3.5m worth of Entertainment Network (India) stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹49m | ₹29m | 98% |

| Other | ₹1.0m | ₹930k | 2% |

| Total Compensation | ₹50m | ₹30m | 100% |

Talking in terms of the industry, salary represented approximately 98% of total compensation out of all the companies we analyzed, while other remuneration made up 2.3% of the pie. Investors will find it interesting that Entertainment Network (India) pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Entertainment Network (India) Limited's Growth Numbers

Entertainment Network (India) Limited has reduced its earnings per share by 58% a year over the last three years. Its revenue is down 38% over the previous year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Entertainment Network (India) Limited Been A Good Investment?

Given the total shareholder loss of 78% over three years, many shareholders in Entertainment Network (India) Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Prashant receives almost all of their compensation through a salary. As previously discussed, Prashant is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. Disappointingly, share price gains over the last three years have failed to materialize. Arguably worse, we've been waiting for positive EPS growth for the last three years. Considering such poor performance, we think shareholders might be concerned if the CEO's compensation were to grow.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Entertainment Network (India) that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Entertainment Network (India), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Entertainment Network (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ENIL

Entertainment Network (India)

Together with its subsidiary, operates FM radio broadcasting stations in India and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026