We Discuss Why Dish TV India Limited's (NSE:DISHTV) CEO Compensation May Be Closely Reviewed

Dish TV India Limited (NSE:DISHTV) has not performed well recently and CEO Anil Dua will probably need to up their game. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 27 September 2021. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for Dish TV India

How Does Total Compensation For Anil Dua Compare With Other Companies In The Industry?

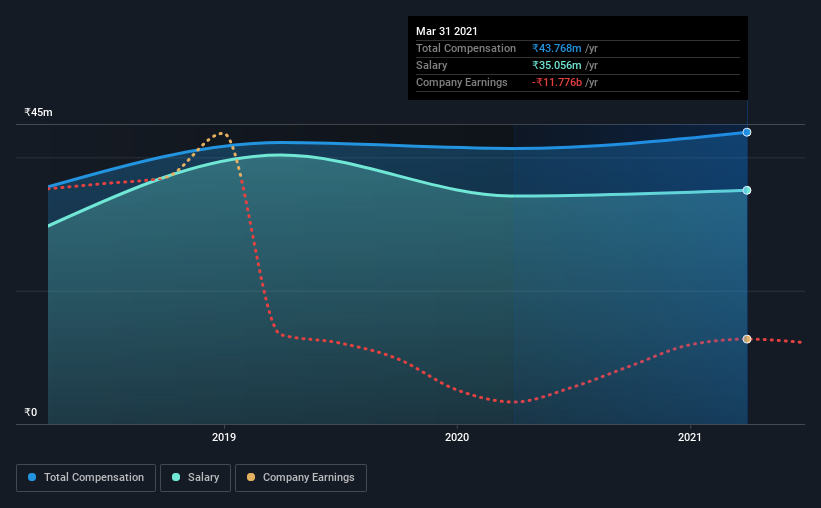

According to our data, Dish TV India Limited has a market capitalization of ₹36b, and paid its CEO total annual compensation worth ₹44m over the year to March 2021. That's a fairly small increase of 5.9% over the previous year. In particular, the salary of ₹35.1m, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between ₹15b and ₹59b, we discovered that the median CEO total compensation of that group was ₹44m. So it looks like Dish TV India compensates Anil Dua in line with the median for the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹35m | ₹34m | 80% |

| Other | ₹8.7m | ₹7.1m | 20% |

| Total Compensation | ₹44m | ₹41m | 100% |

Speaking on an industry level, nearly 99% of total compensation represents salary, while the remainder of 1% is other remuneration. It's interesting to note that Dish TV India allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Dish TV India Limited's Growth

Over the last three years, Dish TV India Limited has shrunk its earnings per share by 43% per year. It saw its revenue drop 9.3% over the last year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Dish TV India Limited Been A Good Investment?

Few Dish TV India Limited shareholders would feel satisfied with the return of -67% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Dish TV India that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Dish TV India, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:DISHTV

Dish TV India

Provides direct to home (DTH) and teleport services in India.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives