Indian Dividend Stocks To Consider: Bank of Baroda And 2 More

Reviewed by Simply Wall St

In the last week, the Indian market has risen by 1.6%, contributing to an impressive 44% increase over the past 12 months, with earnings forecasted to grow by 17% annually. In such a robust market environment, identifying strong dividend stocks like Bank of Baroda and others can be a prudent strategy for investors seeking steady income and potential growth.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.26% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 4.38% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 4.77% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.17% | ★★★★★☆ |

| Bharat Petroleum (NSEI:BPCL) | 6.09% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.56% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.22% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.34% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.81% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.10% | ★★★★★☆ |

Click here to see the full list of 16 stocks from our Top Indian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

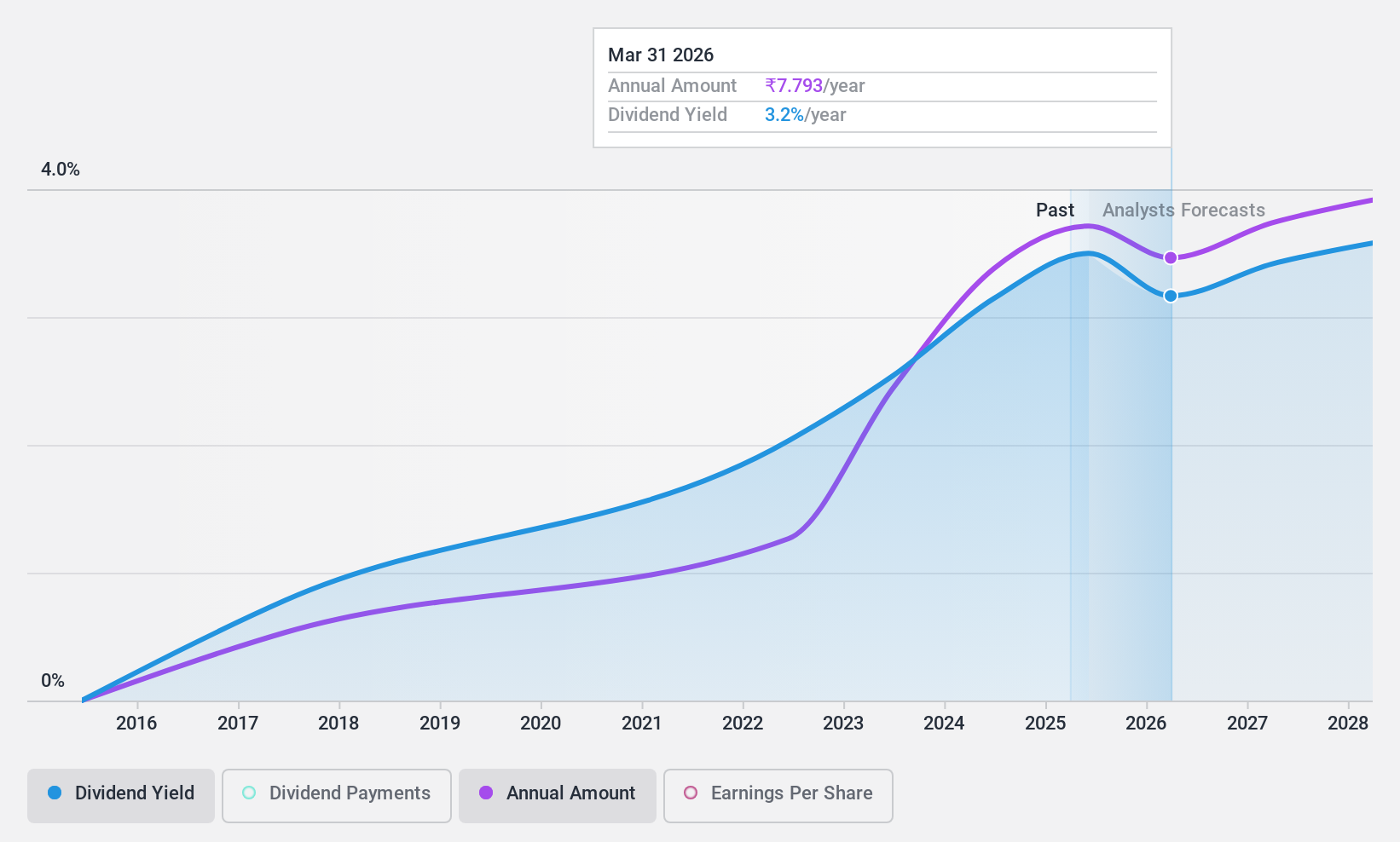

Bank of Baroda (NSEI:BANKBARODA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Baroda Limited offers a range of banking products and services to individuals, government departments, and corporate customers both in India and internationally, with a market cap of ₹1.27 trillion.

Operations: Bank of Baroda Limited generates revenue primarily from Corporate/Wholesale Banking (₹502.78 billion), Retail Banking - Other Retail Banking (₹512.25 billion), Treasury operations (₹316.82 billion), and Other Banking Operations (₹110.76 billion).

Dividend Yield: 3.1%

Bank of Baroda's dividend payments are well covered by earnings with a payout ratio of 20.9%, and this is expected to remain stable at 22.1% over the next three years. Despite its volatile dividend history, the stock offers a competitive yield in India's top 25% for dividend payers. Recent strategic moves include launching a co-branded travel debit card with EaseMyTrip.com, which could enhance customer engagement and potentially support future profitability and dividends.

- Dive into the specifics of Bank of Baroda here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Bank of Baroda shares in the market.

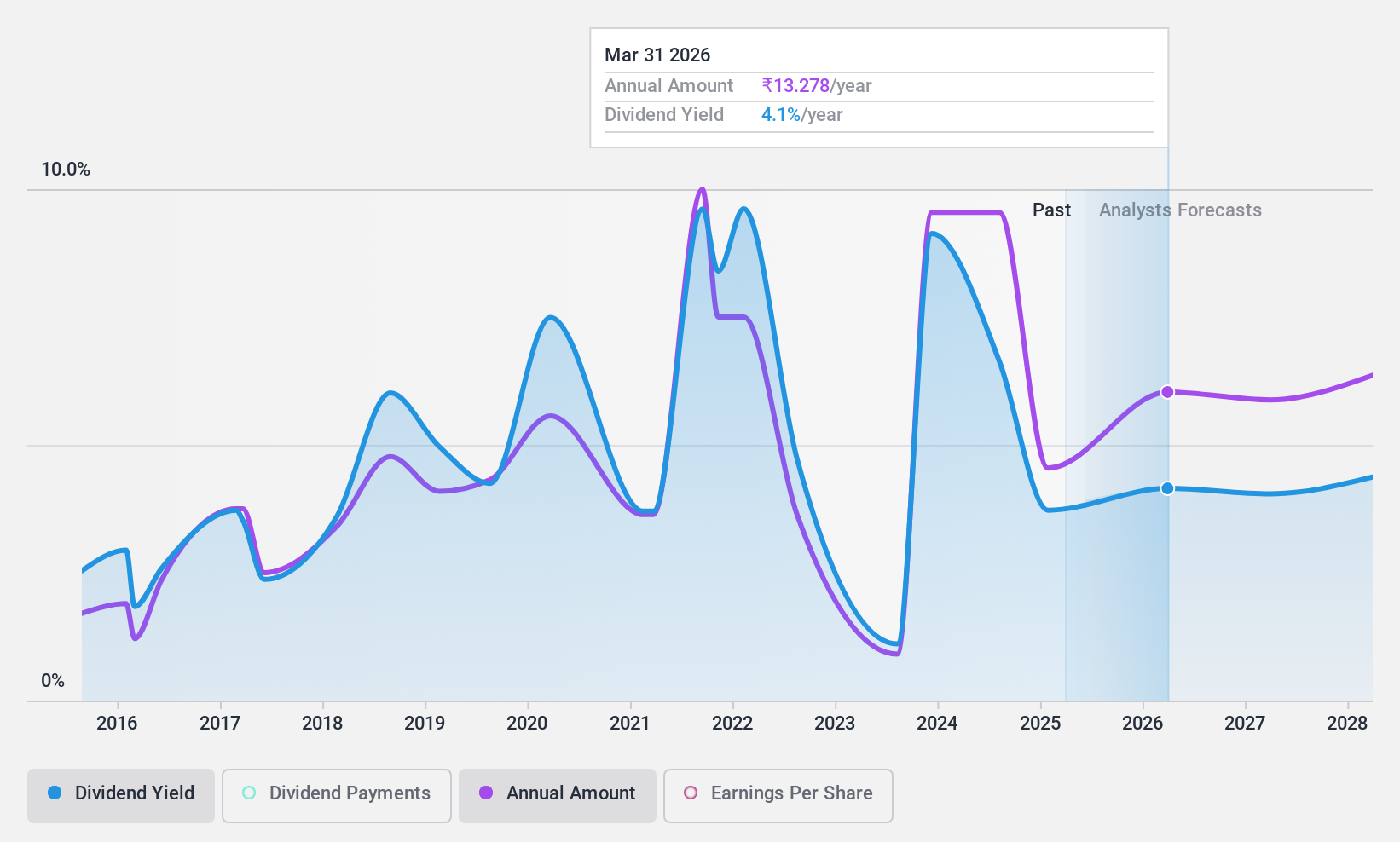

Bharat Petroleum (NSEI:BPCL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bharat Petroleum Corporation Limited primarily engages in refining crude oil and marketing petroleum products in India and internationally, with a market cap of ₹1.50 trillion.

Operations: Bharat Petroleum Corporation Limited's revenue segments include ₹5.07 billion from Downstream Petroleum and ₹1.92 billion from Exploration & Production of Hydrocarbons.

Dividend Yield: 6.1%

Bharat Petroleum's dividend payments are well covered by earnings and cash flows, with payout ratios of 33.3% and 34.6%, respectively. Despite a volatile dividend history, the company offers a competitive yield in India's top 25%. Recent strategic initiatives include joint ventures in renewable energy and compressed biogas, which may bolster long-term sustainability. However, high debt levels and forecasted earnings decline pose risks to future dividend stability.

- Unlock comprehensive insights into our analysis of Bharat Petroleum stock in this dividend report.

- The valuation report we've compiled suggests that Bharat Petroleum's current price could be quite moderate.

D. B (NSEI:DBCORP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms for news and event management businesses in India and internationally, with a market cap of ₹63.44 billion.

Operations: D. B. Corp Limited generates revenue primarily from its printing, publishing, and allied business segment (₹22.77 billion) and radio broadcasting segment (₹1.62 billion).

Dividend Yield: 4.8%

D. B. Corp's dividend payments have been volatile over the past decade, despite a reasonable payout ratio of 65.2% and cash payout ratio of 57%. The company offers a competitive yield in India's top 25% and has seen earnings grow by 114.3% over the past year. However, recent news indicates a decrease in interim dividends to ₹7 per share, highlighting potential instability in future payouts despite strong financial performance.

- Navigate through the intricacies of D. B with our comprehensive dividend report here.

- Our valuation report unveils the possibility D. B's shares may be trading at a discount.

Make It Happen

- Gain an insight into the universe of 16 Top Indian Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Baroda might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BANKBARODA

Bank of Baroda

Provides various banking products and services to individuals, government departments, and corporate customers in India and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives