In the last week, the Indian market has stayed flat, but over the past 12 months, it has risen by an impressive 44%. With earnings expected to grow by 17% per annum over the next few years, identifying dividend stocks that offer both stability and attractive yields is crucial for investors looking to capitalize on this growth.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.20% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 4.27% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.07% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.38% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.20% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.03% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.27% | ★★★★★☆ |

| Canara Bank (NSEI:CANBK) | 3.07% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.68% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.23% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top Indian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

D. B (NSEI:DBCORP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms for news and event management businesses in India and internationally, with a market cap of ₹59.74 billion.

Operations: D. B. Corp Limited generates revenue primarily from its Printing/Publishing and Allied Business segment (₹22.77 billion) and Radio segment (₹1.62 billion).

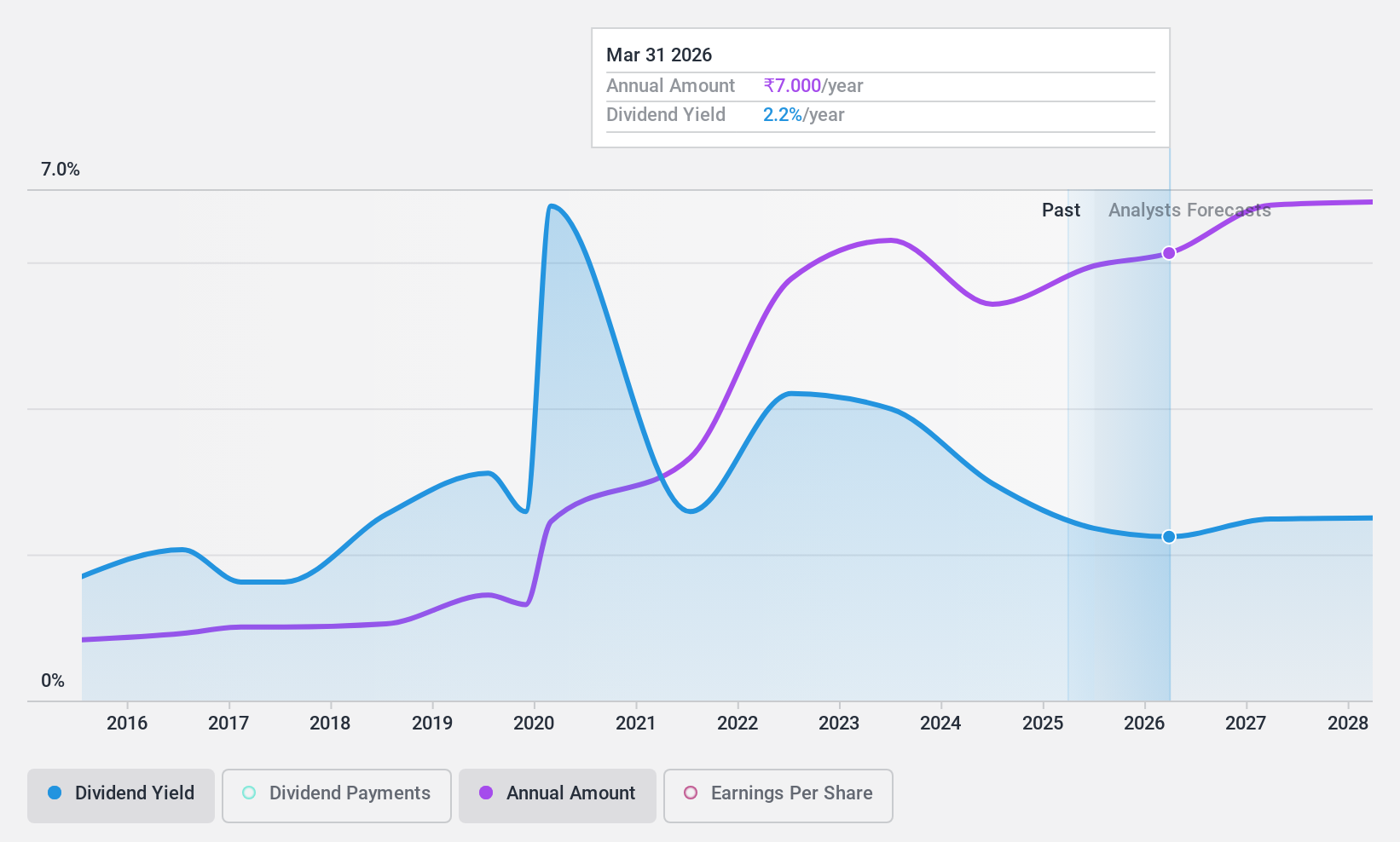

Dividend Yield: 5.1%

D. B. Corp's dividend payments have been volatile and unreliable over the past decade, though they currently offer a high yield in the top 25% of Indian market payers. The dividend is covered by earnings (65.2%) and cash flows (57%), suggesting sustainability despite past instability. Recent earnings show significant growth, with net income rising to ₹1.18 billion for Q1 2024 from ₹787.59 million a year ago, supporting its current dividend payout capabilities.

- Click to explore a detailed breakdown of our findings in D. B's dividend report.

- Upon reviewing our latest valuation report, D. B's share price might be too pessimistic.

Redington (NSEI:REDINGTON)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Redington Limited provides supply chain solutions in India and internationally, with a market cap of ₹148.10 billion.

Operations: Redington Limited's revenue segments include supply chain solutions in India and internationally.

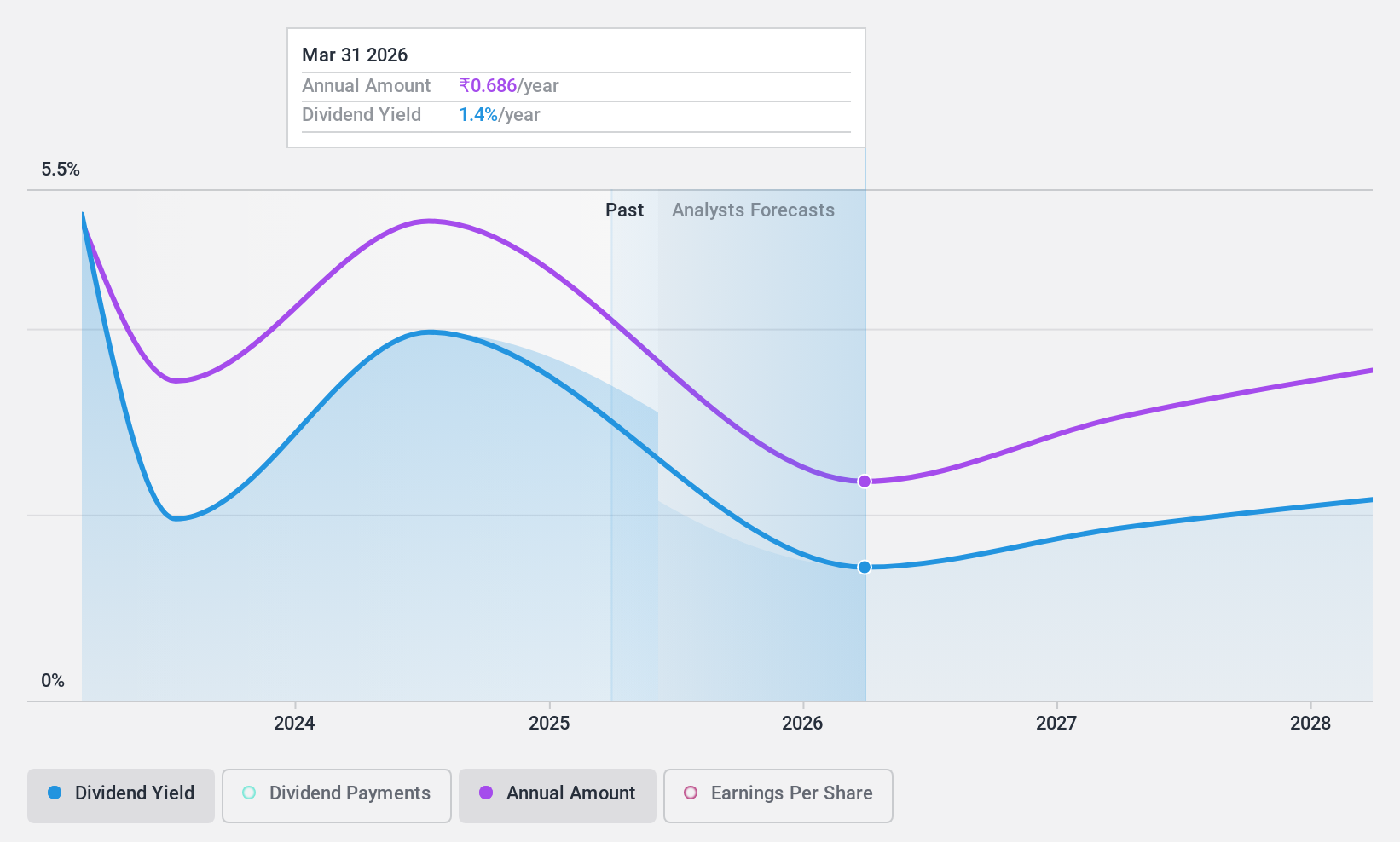

Dividend Yield: 3.3%

Redington's dividend yield is in the top 25% of Indian market payers, with a payout ratio of 39.8% and cash payout ratio of 50.6%, indicating sustainability. However, its dividend track record has been volatile over the past decade. Recent earnings for Q1 2024 showed stable revenue at ₹213.35 billion and net income at ₹2.46 billion, slightly down from last year, but still supporting current dividend payments despite recent decreases to ₹6.20 per share approved in July 2024.

- Click here to discover the nuances of Redington with our detailed analytical dividend report.

- Our valuation report here indicates Redington may be undervalued.

Ujjivan Small Finance Bank (NSEI:UJJIVANSFB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ujjivan Small Finance Bank Limited provides various banking and financial services in India and has a market cap of ₹82.92 billion.

Operations: Ujjivan Small Finance Bank Limited generates revenue from three primary segments: Treasury (₹7.58 billion), Retail Banking (₹58.71 billion), and Wholesale Banking (₹1.44 billion).

Dividend Yield: 3.5%

Ujjivan Small Finance Bank's dividend yield is among the top 25% in India, with a low payout ratio of 22.6%, indicating strong coverage by earnings. However, its dividend history has been volatile over the past two years, and payments have not increased since inception. Despite this, analysts forecast continued earnings growth and sustainable future dividends with a projected payout ratio of 16.2% in three years. Recent Q1 earnings reported net income at ₹3 billion, supporting current payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Ujjivan Small Finance Bank.

- According our valuation report, there's an indication that Ujjivan Small Finance Bank's share price might be on the cheaper side.

Taking Advantage

- Delve into our full catalog of 18 Top Indian Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:UJJIVANSFB

Ujjivan Small Finance Bank

Provides various banking and financial services in India.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives