I Ran A Stock Scan For Earnings Growth And Affle (India) (NSE:AFFLE) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Affle (India) (NSE:AFFLE). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Affle (India)

How Fast Is Affle (India) Growing Its Earnings Per Share?

Over the last three years, Affle (India) has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Affle (India)'s EPS shot from ₹26.13 to ₹52.96, over the last year. Year on year growth of 103% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

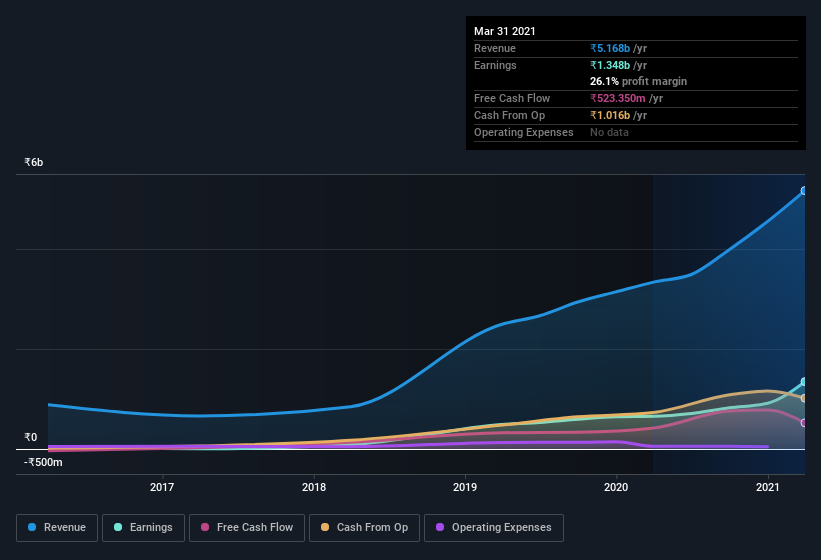

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Affle (India) maintained stable EBIT margins over the last year, all while growing revenue 55% to ₹5.2b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Affle (India)?

Are Affle (India) Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that Affle (India) insiders spent ₹7.9m on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by Independent & Non-Executive Director Vivek Gour for ₹3.6m worth of shares, at about ₹3,034 per share.

I do like that insiders have been buying shares in Affle (India), but there is more evidence of shareholder friendly management. I refer to the very reasonable level of CEO pay. For companies with market capitalizations between ₹75b and ₹238b, like Affle (India), the median CEO pay is around ₹32m.

The Affle (India) CEO received total compensation of only ₹253k in the year to . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Affle (India) Deserve A Spot On Your Watchlist?

Affle (India)'s earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests Affle (India) may be at an inflection point. For those chasing fast growth, then, I'd suggest to stock merits monitoring. You should always think about risks though. Case in point, we've spotted 3 warning signs for Affle (India) you should be aware of, and 1 of them makes us a bit uncomfortable.

As a growth investor I do like to see insider buying. But Affle (India) isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Affle (India), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Affle (India), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:AFFLE

Affle (India)

Provides mobile advertisement services through information technology and software development services for mobiles in India and internationally.

Flawless balance sheet with solid track record.