3 Indian Exchange Stocks Estimated To Be Undervalued By 20.5% To 48%

Reviewed by Simply Wall St

In the last week, the Indian market has been flat, but over the past 12 months, it has risen by an impressive 43%, with earnings expected to grow by 17% per annum over the next few years. In this environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹185.05 | ₹306.09 | 39.5% |

| Krsnaa Diagnostics (NSEI:KRSNAA) | ₹729.35 | ₹1165.33 | 37.4% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹821.40 | ₹1509.79 | 45.6% |

| Apollo Pipes (BSE:531761) | ₹658.00 | ₹1152.46 | 42.9% |

| RITES (NSEI:RITES) | ₹650.40 | ₹1036.75 | 37.3% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2305.35 | ₹4431.76 | 48% |

| Updater Services (NSEI:UDS) | ₹366.45 | ₹620.15 | 40.9% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹461.75 | ₹762.32 | 39.4% |

| Patel Engineering (BSE:531120) | ₹58.23 | ₹93.79 | 37.9% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹269.90 | ₹445.15 | 39.4% |

Here's a peek at a few of the choices from the screener.

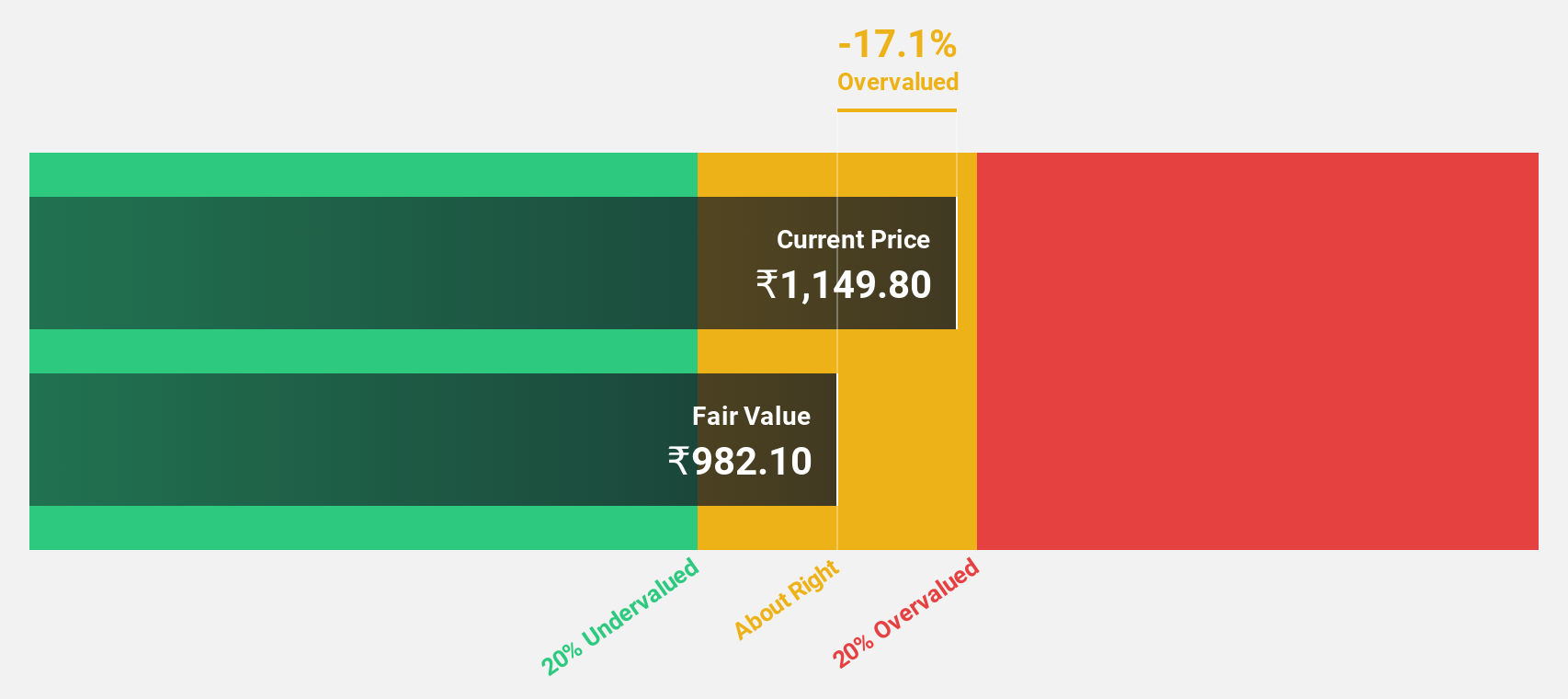

Kalpataru Projects International (NSEI:KPIL)

Overview: Kalpataru Projects International Limited offers engineering, procurement, and construction (EPC) services across power transmission and distribution, buildings and factories, water, railways, oil and gas, and urban infrastructure sectors in India and internationally with a market cap of ₹227.43 billion.

Operations: The company's revenue segments include ₹194.92 billion from Engineering, Procurement and Construction (EPC) services and ₹2.81 billion from Development Projects.

Estimated Discount To Fair Value: 20.5%

Kalpataru Projects International appears undervalued based on cash flows, trading at ₹1400.05, below its estimated fair value of ₹1761.24. Despite recent GST-related enforcement actions demanding significant tax and penalties, the company maintains a strong defense and plans to appeal. Revenue is forecasted to grow faster than the Indian market at 13% per year, while earnings are expected to rise significantly by 29% annually over the next three years.

- The analysis detailed in our Kalpataru Projects International growth report hints at robust future financial performance.

- Dive into the specifics of Kalpataru Projects International here with our thorough financial health report.

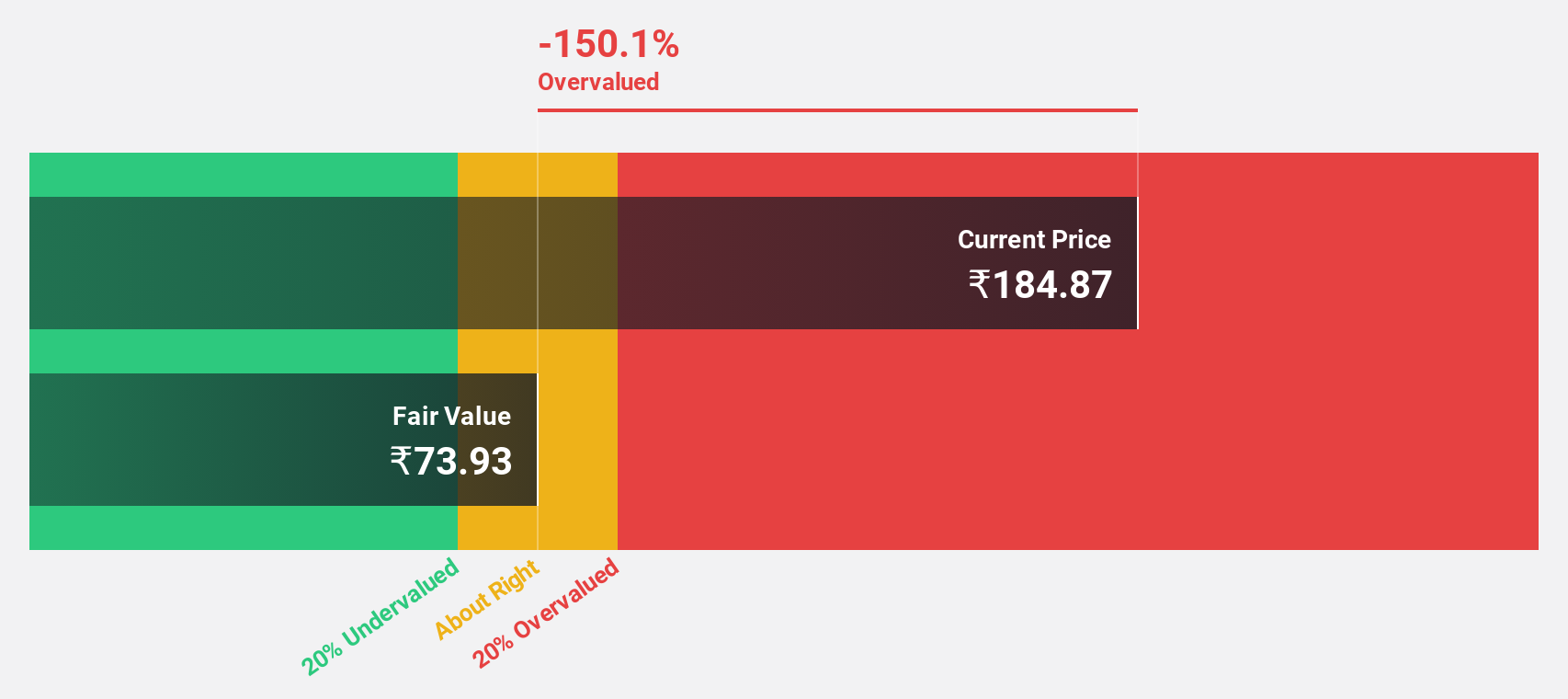

Piramal Pharma (NSEI:PPLPHARMA)

Overview: Piramal Pharma Limited operates as a pharmaceutical company in North America, Europe, Japan, India, and internationally with a market cap of ₹282.42 billion.

Operations: The company's revenue primarily comes from its pharmaceutical segment, which generated ₹83.73 billion.

Estimated Discount To Fair Value: 26.4%

Piramal Pharma is trading at ₹213.03, significantly below its fair value estimate of ₹289.56, indicating it may be undervalued based on cash flows. Despite recent regulatory penalties and a net loss of INR 886.4 million in Q1 2024, the company's revenue grew to INR 19,706.8 million from INR 17,871.6 million year-on-year. Forecasts suggest substantial earnings growth of over 73% annually for the next three years, outpacing the Indian market's average growth rate.

- Our comprehensive growth report raises the possibility that Piramal Pharma is poised for substantial financial growth.

- Navigate through the intricacies of Piramal Pharma with our comprehensive financial health report here.

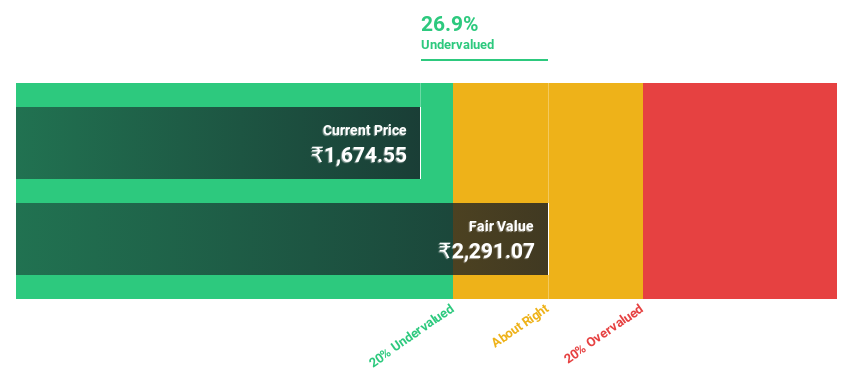

Venus Pipes and Tubes (NSEI:VENUSPIPES)

Overview: Venus Pipes and Tubes Limited manufactures and sells stainless-steel pipes and tubes worldwide, with a market cap of ₹46.95 billion.

Operations: The company's revenue primarily comes from the manufacturing and trading of pipes, tubes, and steel, amounting to ₹8.63 billion.

Estimated Discount To Fair Value: 48%

Venus Pipes and Tubes, trading at ₹2305.35, is significantly undervalued with a fair value estimate of ₹4431.76. Recent earnings showed strong performance, with Q1 2024 net income rising to INR 275.56 million from INR 174.06 million year-on-year. Revenue forecasts are robust at 23% annually, outpacing the Indian market's average growth rate of 10%. The company's earnings are expected to grow by more than 29% per year over the next three years.

- Our growth report here indicates Venus Pipes and Tubes may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Venus Pipes and Tubes' balance sheet health report.

Taking Advantage

- Explore the 29 names from our Undervalued Indian Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PPLPHARMA

Piramal Pharma

Operates as a pharmaceutical company in North America, Europe, Japan, India, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives