- India

- /

- Aerospace & Defense

- /

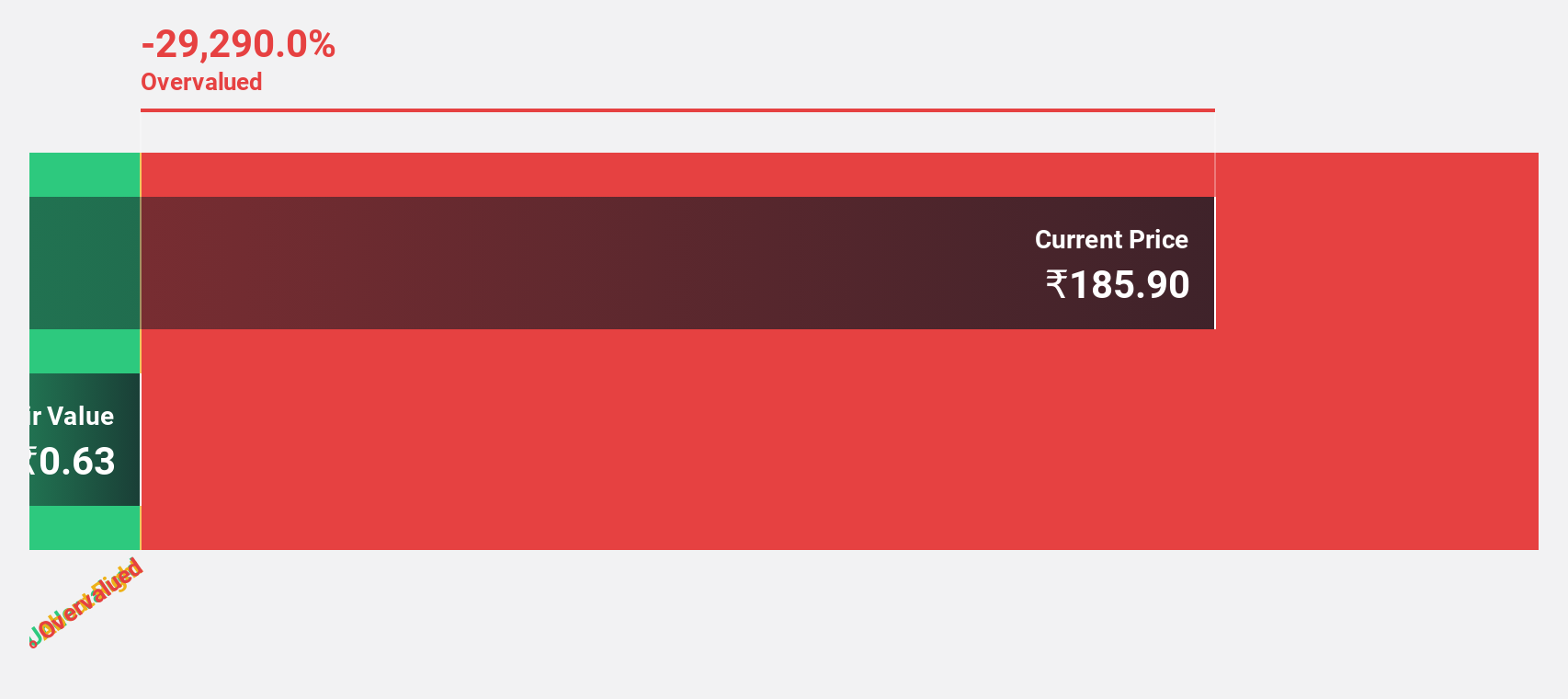

- NSEI:APOLLO

Apollo Micro Systems And 2 Other Indian Exchange Stocks That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

The Indian stock market has experienced a robust growth of 46% over the past year, with earnings expected to increase by 16% annually. In such a thriving market, identifying stocks like Apollo Micro Systems that are potentially undervalued can be particularly compelling for investors looking for value in a rising market environment.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Updater Services (NSEI:UDS) | ₹297.85 | ₹477.16 | 37.6% |

| Allied Digital Services (NSEI:ADSL) | ₹155.17 | ₹228.94 | 32.2% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹415.80 | ₹574.52 | 27.6% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹476.15 | ₹801.12 | 40.6% |

| Strides Pharma Science (NSEI:STAR) | ₹945.40 | ₹1520.38 | 37.8% |

| TV18 Broadcast (NSEI:TV18BRDCST) | ₹43.68 | ₹70.66 | 38.2% |

| PVR INOX (NSEI:PVRINOX) | ₹1436.85 | ₹2222.35 | 35.3% |

| Delhivery (NSEI:DELHIVERY) | ₹399.15 | ₹611.60 | 34.7% |

| Camlin Fine Sciences (BSE:532834) | ₹108.40 | ₹156.85 | 30.9% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3007.30 | ₹4553.23 | 34% |

Let's explore several standout options from the results in the screener

Apollo Micro Systems (NSEI:APOLLO)

Overview: Apollo Micro Systems Limited specializes in designing, developing, assembling, and testing electronic and electro-mechanical solutions in India, with a market capitalization of approximately ₹34.38 billion.

Operations: The company generates revenue primarily from electromechanical components and systems, as well as allied components and services, totaling approximately ₹3.72 billion.

Estimated Discount To Fair Value: 10.3%

Apollo Micro Systems, with a current trading price of INR 112.18, appears undervalued based on cash flow analysis, showing a potential fair value of INR 125.05. The company's earnings have grown by 66% over the past year and are projected to increase by approximately 50.75% annually. Despite recent revenue growth outpacing the market at 37.4% yearly, Apollo's Return on Equity is expected to remain low at around 14.2% in three years' time, indicating some concerns about future profitability and efficiency in generating shareholder value from equity investments.

- The growth report we've compiled suggests that Apollo Micro Systems' future prospects could be on the up.

- Dive into the specifics of Apollo Micro Systems here with our thorough financial health report.

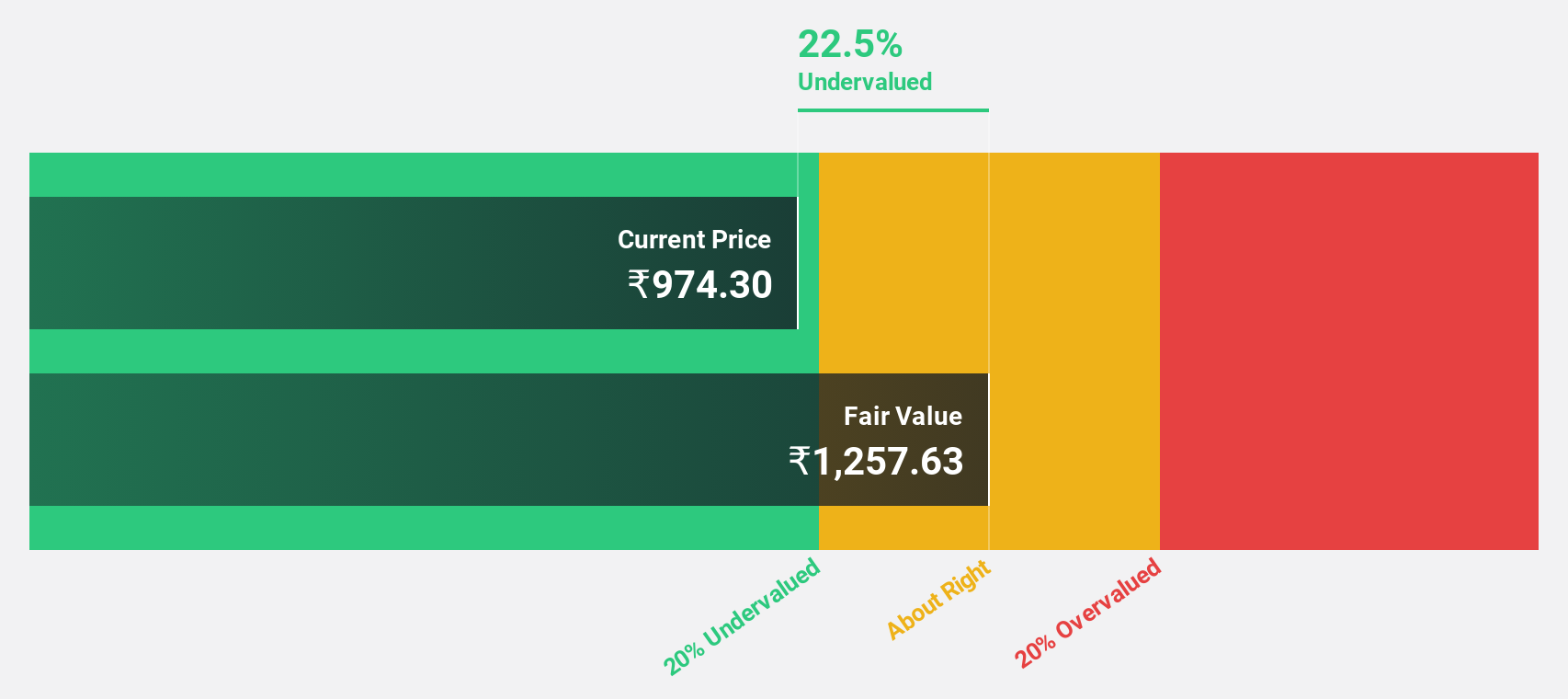

PVR INOX (NSEI:PVRINOX)

Overview: PVR INOX Limited operates as a theatrical exhibition company, involved in the exhibition, distribution, and production of movies across India and Sri Lanka, with a market capitalization of approximately ₹140.99 billion.

Operations: The company generates revenue primarily through movie exhibition, which brought in ₹60.71 billion, and other activities including movie production and distribution, contributing ₹3.17 billion.

Estimated Discount To Fair Value: 35.3%

PVR INOX, priced at ₹1436.85, is trading significantly below its estimated fair value of ₹2222.35, indicating strong undervaluation based on discounted cash flow analysis. The company's revenue growth forecast at 11.3% annually outpaces the broader Indian market's 9.6%, with profitability expected within three years—a positive turnaround from recent losses. However, its projected Return on Equity of 9.8% suggests moderate efficiency in generating shareholder value in the future. Recent expansions into new markets and enhanced cinematic technologies could support growth but also warrant cautious optimism given the financial transitions and competitive industry landscape.

- Upon reviewing our latest growth report, PVR INOX's projected financial performance appears quite optimistic.

- Click here to discover the nuances of PVR INOX with our detailed financial health report.

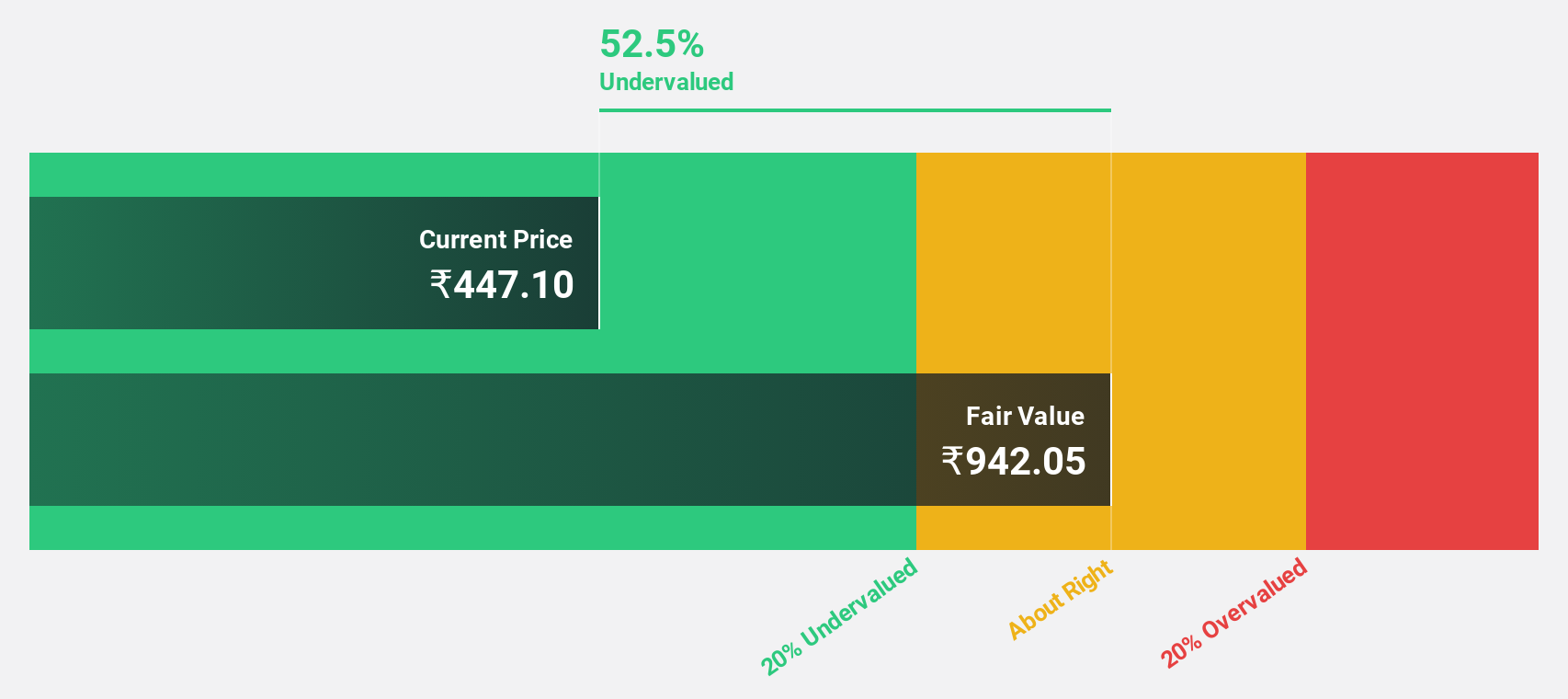

Vedanta (NSEI:VEDL)

Overview: Vedanta Limited is a diversified natural resources company involved in exploring, extracting, and processing minerals and oil and gas across India, Europe, China, the United States, Mexico, and internationally, with a market cap of approximately ₹1.74 trillion.

Operations: Vedanta's revenue is primarily generated from Aluminium (₹483.71 billion), Zinc - India (₹279.25 billion), Copper (₹197.30 billion), Oil and Gas (₹178.37 billion), Power (₹61.53 billion), Iron Ore (₺90.69 billion), and Zinc - International (₹35.56 billion).

Estimated Discount To Fair Value: 26.5%

Vedanta Limited, with a current trading price of ₹470.25, appears undervalued by over 20% compared to its fair value estimate of ₹640.14 based on discounted cash flow analysis. Despite revenue growth projections trailing the broader Indian market at 6.6% annually versus 9.6%, Vedanta's earnings are expected to surge by 42.8% per year, outpacing the market forecast of 15.9%. However, the firm grapples with a high debt level and declining profit margins—down from last year's 7.2% to this year's 3%. Recent strategic moves include plans to monetize its steel business and reduce debt, enhancing financial flexibility despite operational challenges like regulatory penalties and temporary suspensions in mining operations.

- In light of our recent growth report, it seems possible that Vedanta's financial performance will exceed current levels.

- Take a closer look at Vedanta's balance sheet health here in our report.

Summing It All Up

- Reveal the 17 hidden gems among our Undervalued Indian Stocks Based On Cash Flows screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:APOLLO

Apollo Micro Systems

Designs, develops, and assembles electronic and electromechanical solutions in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026