Universus Photo Imagings (NSE:UNIVPHOTO) Could Be Struggling To Allocate Capital

What underlying fundamental trends can indicate that a company might be in decline? When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. Having said that, after a brief look, Universus Photo Imagings (NSE:UNIVPHOTO) we aren't filled with optimism, but let's investigate further.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Universus Photo Imagings:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0027 = ₹24m ÷ (₹8.8b - ₹17m) (Based on the trailing twelve months to March 2024).

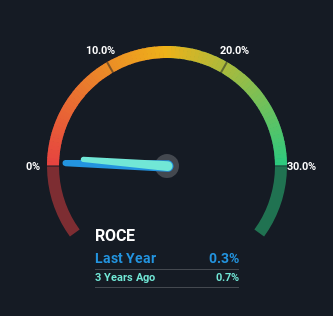

Therefore, Universus Photo Imagings has an ROCE of 0.3%. Ultimately, that's a low return and it under-performs the Chemicals industry average of 13%.

See our latest analysis for Universus Photo Imagings

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Universus Photo Imagings' past further, check out this free graph covering Universus Photo Imagings' past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

The trend of returns that Universus Photo Imagings is generating are raising some concerns. Unfortunately, returns have declined substantially over the last four years to the 0.3% we see today. In addition to that, Universus Photo Imagings is now employing 28% less capital than it was four years ago. When you see both ROCE and capital employed diminishing, it can often be a sign of a mature and shrinking business that might be in structural decline. Typically businesses that exhibit these characteristics aren't the ones that tend to multiply over the long term, because statistically speaking, they've already gone through the growth phase of their life cycle.

In Conclusion...

To see Universus Photo Imagings reducing the capital employed in the business in tandem with diminishing returns, is concerning. However the stock has delivered a 53% return to shareholders over the last three years, so investors might be expecting the trends to turn around. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

One final note, you should learn about the 3 warning signs we've spotted with Universus Photo Imagings (including 1 which makes us a bit uncomfortable) .

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:UNIVPHOTO

Universus Photo Imagings

Manufactures, trades, and sells photographic and other imaging products.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026