- India

- /

- Basic Materials

- /

- NSEI:ULTRACEMCO

UltraTech Cement Limited's (NSE:ULTRACEMCO) Stock Has Fared Decently: Is the Market Following Strong Financials?

UltraTech Cement's (NSE:ULTRACEMCO) stock up by 4.2% over the past three months. Since the market usually pay for a company’s long-term financial health, we decided to study the company’s fundamentals to see if they could be influencing the market. In this article, we decided to focus on UltraTech Cement's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for UltraTech Cement

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for UltraTech Cement is:

12% = ₹70b ÷ ₹603b (Based on the trailing twelve months to June 2024).

The 'return' refers to a company's earnings over the last year. So, this means that for every ₹1 of its shareholder's investments, the company generates a profit of ₹0.12.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

UltraTech Cement's Earnings Growth And 12% ROE

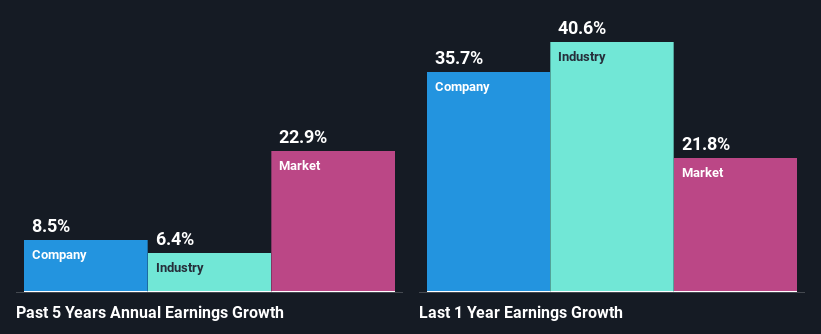

At first glance, UltraTech Cement's ROE doesn't look very promising. However, the fact that the company's ROE is higher than the average industry ROE of 7.6%, is definitely interesting. This certainly adds some context to UltraTech Cement's moderate 8.5% net income growth seen over the past five years. That being said, the company does have a slightly low ROE to begin with, just that it is higher than the industry average. Therefore, the growth in earnings could also be the result of other factors. Such as- high earnings retention or the company belonging to a high growth industry.

As a next step, we compared UltraTech Cement's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 6.4%.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if UltraTech Cement is trading on a high P/E or a low P/E, relative to its industry.

Is UltraTech Cement Efficiently Re-investing Its Profits?

UltraTech Cement's three-year median payout ratio to shareholders is 22% (implying that it retains 78% of its income), which is on the lower side, so it seems like the management is reinvesting profits heavily to grow its business.

Moreover, UltraTech Cement is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 21%. However, UltraTech Cement's ROE is predicted to rise to 15% despite there being no anticipated change in its payout ratio.

Summary

In total, we are pretty happy with UltraTech Cement's performance. Particularly, we like that the company is reinvesting heavily into its business at a moderate rate of return. Unsurprisingly, this has led to an impressive earnings growth. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ULTRACEMCO

UltraTech Cement

Engages in the manufacture and sale of clinker, cement, ready mix concrete, and related products in India, the United Arab Emirates, Bahrain, and Sri Lanka.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion