- India

- /

- Basic Materials

- /

- NSEI:ULTRACEMCO

Returns At UltraTech Cement (NSE:ULTRACEMCO) Appear To Be Weighed Down

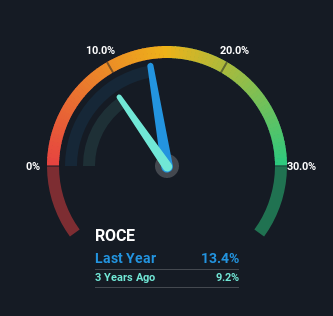

If you're looking for a multi-bagger, there's a few things to keep an eye out for. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So, when we ran our eye over UltraTech Cement's (NSE:ULTRACEMCO) trend of ROCE, we liked what we saw.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for UltraTech Cement, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = ₹86b ÷ (₹838b - ₹202b) (Based on the trailing twelve months to June 2022).

Therefore, UltraTech Cement has an ROCE of 13%. In absolute terms, that's a satisfactory return, but compared to the Basic Materials industry average of 10% it's much better.

View our latest analysis for UltraTech Cement

In the above chart we have measured UltraTech Cement's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

The Trend Of ROCE

While the current returns on capital are decent, they haven't changed much. The company has consistently earned 13% for the last five years, and the capital employed within the business has risen 88% in that time. 13% is a pretty standard return, and it provides some comfort knowing that UltraTech Cement has consistently earned this amount. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

The Key Takeaway

The main thing to remember is that UltraTech Cement has proven its ability to continually reinvest at respectable rates of return. And since the stock has risen strongly over the last five years, it appears the market might expect this trend to continue. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

UltraTech Cement could be trading at an attractive price in other respects, so you might find our free intrinsic value estimation on our platform quite valuable.

While UltraTech Cement isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you're looking to trade UltraTech Cement, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ULTRACEMCO

UltraTech Cement

Primarily engages in the manufacture and sale of clinker, cement, and related products in India.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives