- India

- /

- Basic Materials

- /

- NSEI:UDAICEMENT

Shareholders Shouldn’t Be Too Comfortable With Udaipur Cement Works' (NSE:UDAICEMENT) Strong Earnings

The latest earnings release from Udaipur Cement Works Limited (NSE:UDAICEMENT ) disappointed investors. We did some analysis and believe that they might be concerned about some weak underlying factors.

See our latest analysis for Udaipur Cement Works

A Closer Look At Udaipur Cement Works' Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

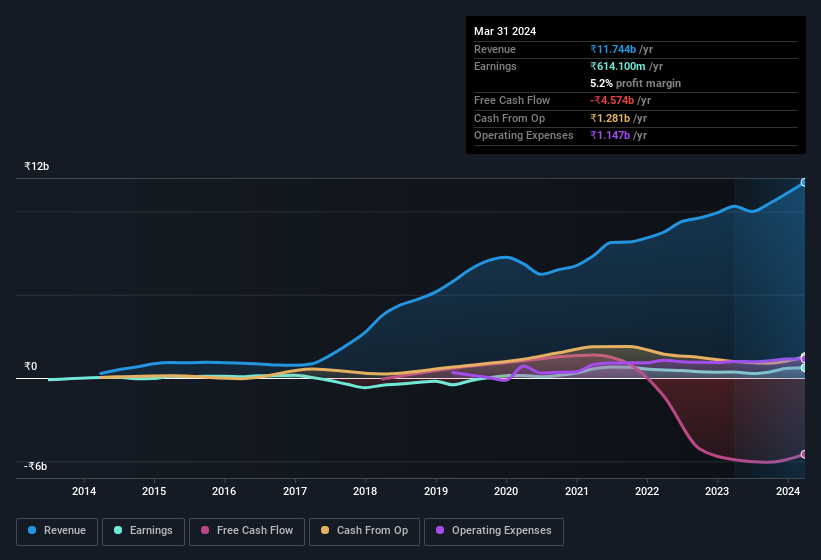

For the year to March 2024, Udaipur Cement Works had an accrual ratio of 0.29. Unfortunately, that means its free cash flow was a lot less than its statutory profit, which makes us doubt the utility of profit as a guide. Over the last year it actually had negative free cash flow of ₹4.6b, in contrast to the aforementioned profit of ₹614.1m. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of ₹4.6b, this year, indicates high risk. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Udaipur Cement Works.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Udaipur Cement Works issued 80% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Udaipur Cement Works' historical EPS growth by clicking on this link.

A Look At The Impact Of Udaipur Cement Works' Dilution On Its Earnings Per Share (EPS)

Udaipur Cement Works has improved its profit over the last three years, with an annualized gain of 12% in that time. In contrast, earnings per share were actually down by 29% per year, in the exact same period. And the 71% profit boost in the last year certainly seems impressive at first glance. On the other hand, earnings per share are only up 8.6% in that time. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Udaipur Cement Works can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Udaipur Cement Works' Profit Performance

As it turns out, Udaipur Cement Works couldn't match its profit with cashflow and its dilution means that earnings per share growth is lagging net income growth. Considering all this we'd argue Udaipur Cement Works' profits probably give an overly generous impression of its sustainable level of profitability. So while earnings quality is important, it's equally important to consider the risks facing Udaipur Cement Works at this point in time. For example, we've discovered 4 warning signs that you should run your eye over to get a better picture of Udaipur Cement Works.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:UDAICEMENT

Udaipur Cement Works

Manufactures and supplies cement and cementitious products in India.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026