Tamilnadu Petroproducts (NSE:TNPETRO) Is Very Good At Capital Allocation

If you're looking for a multi-bagger, there's a few things to keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So when we looked at the ROCE trend of Tamilnadu Petroproducts (NSE:TNPETRO) we really liked what we saw.

What is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Tamilnadu Petroproducts, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

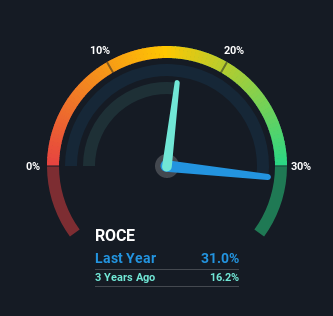

0.31 = ₹2.3b ÷ (₹9.6b - ₹2.2b) (Based on the trailing twelve months to September 2021).

So, Tamilnadu Petroproducts has an ROCE of 31%. In absolute terms that's a great return and it's even better than the Chemicals industry average of 17%.

Check out our latest analysis for Tamilnadu Petroproducts

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Tamilnadu Petroproducts, check out these free graphs here.

So How Is Tamilnadu Petroproducts' ROCE Trending?

Tamilnadu Petroproducts is displaying some positive trends. Over the last five years, returns on capital employed have risen substantially to 31%. The amount of capital employed has increased too, by 117%. So we're very much inspired by what we're seeing at Tamilnadu Petroproducts thanks to its ability to profitably reinvest capital.

Our Take On Tamilnadu Petroproducts' ROCE

In summary, it's great to see that Tamilnadu Petroproducts can compound returns by consistently reinvesting capital at increasing rates of return, because these are some of the key ingredients of those highly sought after multi-baggers. Since the stock has returned a staggering 346% to shareholders over the last five years, it looks like investors are recognizing these changes. In light of that, we think it's worth looking further into this stock because if Tamilnadu Petroproducts can keep these trends up, it could have a bright future ahead.

If you want to continue researching Tamilnadu Petroproducts, you might be interested to know about the 1 warning sign that our analysis has discovered.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

Valuation is complex, but we're here to simplify it.

Discover if Tamilnadu Petroproducts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TNPETRO

Tamilnadu Petroproducts

Manufactures and sells petrochemical and industrial intermediate chemical products in India.

Excellent balance sheet and good value.

Market Insights

Community Narratives