Time Technoplast Limited (NSE:TIMETECHNO) Stock Rockets 28% But Many Are Still Ignoring The Company

Despite an already strong run, Time Technoplast Limited (NSE:TIMETECHNO) shares have been powering on, with a gain of 28% in the last thirty days. The annual gain comes to 235% following the latest surge, making investors sit up and take notice.

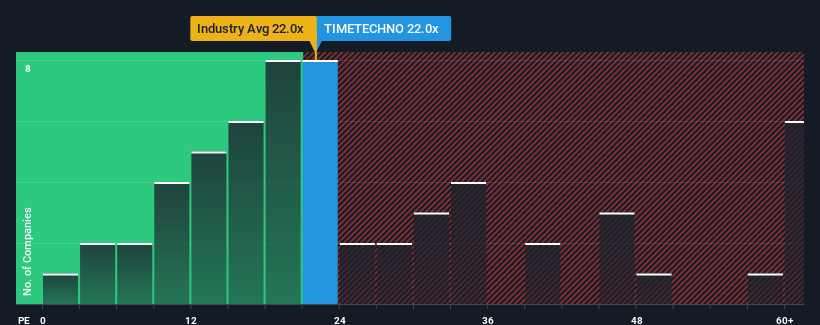

In spite of the firm bounce in price, Time Technoplast may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 22x, since almost half of all companies in India have P/E ratios greater than 32x and even P/E's higher than 58x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Time Technoplast has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Time Technoplast

How Is Time Technoplast's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Time Technoplast's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 34% last year. The strong recent performance means it was also able to grow EPS by 213% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 24% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Time Technoplast is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Time Technoplast's P/E

Time Technoplast's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Time Technoplast revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Time Technoplast that you should be aware of.

You might be able to find a better investment than Time Technoplast. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Time Technoplast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TIMETECHNO

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)