- India

- /

- Metals and Mining

- /

- NSEI:TEMBO

We Take A Look At Why Tembo Global Industries Limited's (NSE:TEMBO) CEO Has Earned Their Pay Packet

The performance at Tembo Global Industries Limited (NSE:TEMBO) has been quite strong recently and CEO Sanjay Patel has played a role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 20 December 2022. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for Tembo Global Industries

Comparing Tembo Global Industries Limited's CEO Compensation With The Industry

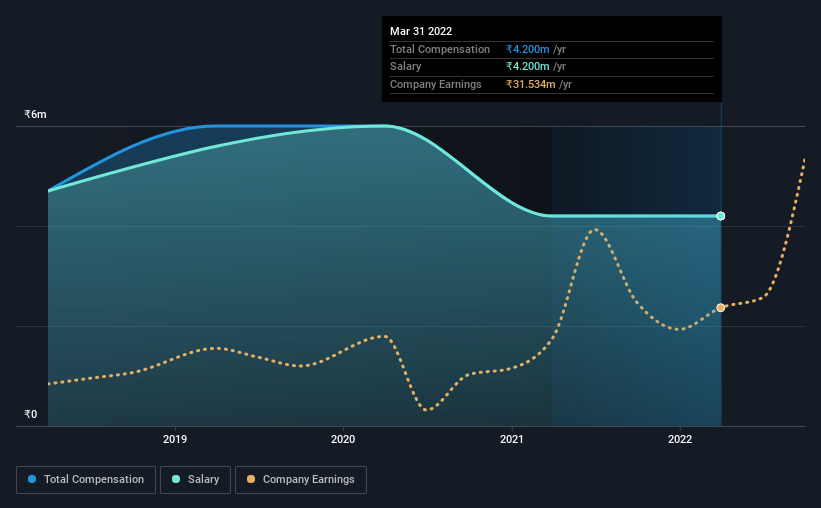

At the time of writing, our data shows that Tembo Global Industries Limited has a market capitalization of ₹1.3b, and reported total annual CEO compensation of ₹4.2m for the year to March 2022. There was no change in the compensation compared to last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹4.2m.

For comparison, other companies in the industry with market capitalizations below ₹17b, reported a median total CEO compensation of ₹4.0m. So it looks like Tembo Global Industries compensates Sanjay Patel in line with the median for the industry. Moreover, Sanjay Patel also holds ₹239m worth of Tembo Global Industries stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹4.2m | ₹4.2m | 100% |

| Other | - | - | - |

| Total Compensation | ₹4.2m | ₹4.2m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. On a company level, Tembo Global Industries prefers to reward its CEO through a salary, opting not to pay Sanjay Patel through non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Tembo Global Industries Limited's Growth

Tembo Global Industries Limited's earnings per share (EPS) grew 59% per year over the last three years. Its revenue is up 41% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Tembo Global Industries Limited Been A Good Investment?

Most shareholders would probably be pleased with Tembo Global Industries Limited for providing a total return of 99% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Tembo Global Industries rewards its CEO solely through a salary, ignoring non-salary benefits completely. Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 5 warning signs (and 1 which makes us a bit uncomfortable) in Tembo Global Industries we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tembo Global Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TEMBO

Tembo Global Industries

Engages in jobbing, machining, manufacturing, and fabrication of engineering goods, steel products, nuts, bolts, clamps, and hangers in India and internationally.

Solid track record with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)