- India

- /

- Metals and Mining

- /

- NSEI:TATASTEEL

Does Tata Steel's (NSE:TATASTEEL) Share Price Gain of 54% Match Its Business Performance?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, the Tata Steel Limited (NSE:TATASTEEL) share price is up 54% in the last three years, clearly besting than the market return of around 29% (not including dividends).

See our latest analysis for Tata Steel

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

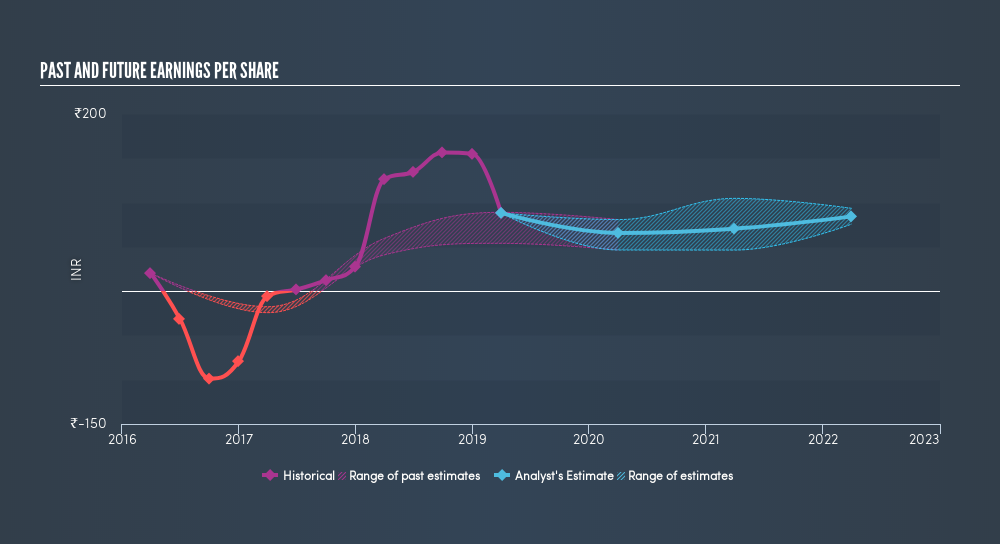

During three years of share price growth, Tata Steel achieved compound earnings per share growth of 63% per year. The average annual share price increase of 15% is actually lower than the EPS growth. So one could reasonably conclude that the market has cooled on the stock. We'd venture the lowish P/E ratio of 5.71 also reflects the negative sentiment around the stock.

We know that Tata Steel has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Tata Steel's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Tata Steel's TSR for the last 3 years was 71%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 3.0% in the last year, Tata Steel shareholders lost 9.6% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 1.9% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Is Tata Steel cheap compared to other companies? These 3 valuation measures might help you decide.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:TATASTEEL

Tata Steel

Engages in the manufacture and distribution of steel products in India and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives