- India

- /

- Metals and Mining

- /

- NSEI:SURANI

Risks Still Elevated At These Prices As Surani Steel Tubes Limited (NSE:SURANI) Shares Dive 26%

Unfortunately for some shareholders, the Surani Steel Tubes Limited (NSE:SURANI) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 72% share price decline.

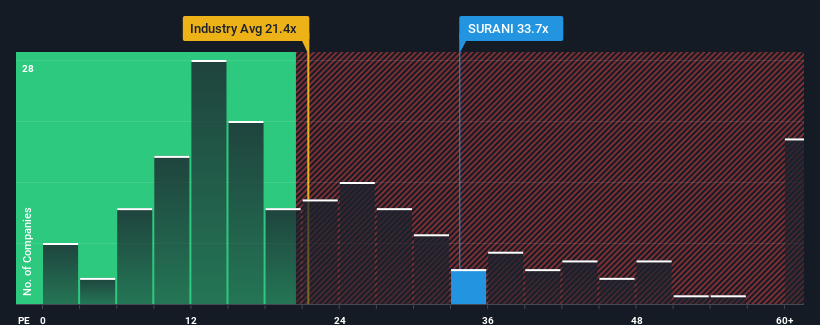

Even after such a large drop in price, Surani Steel Tubes may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 33.7x, since almost half of all companies in India have P/E ratios under 26x and even P/E's lower than 14x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Surani Steel Tubes has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Surani Steel Tubes

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Surani Steel Tubes' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 44% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 53% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 25% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Surani Steel Tubes is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Despite the recent share price weakness, Surani Steel Tubes' P/E remains higher than most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Surani Steel Tubes currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Surani Steel Tubes.

If these risks are making you reconsider your opinion on Surani Steel Tubes, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SURANI

Surani Steel Tubes

Engages in the manufacture and supply of ERW mild steel (MS) pipes and steel tubes in India.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives