Southern Petrochemical Industries (NSE:SPIC) Will Will Want To Turn Around Its Return Trends

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at Southern Petrochemical Industries (NSE:SPIC) and its ROCE trend, we weren't exactly thrilled.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Southern Petrochemical Industries:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = ₹588m ÷ (₹20b - ₹15b) (Based on the trailing twelve months to December 2020).

Therefore, Southern Petrochemical Industries has an ROCE of 12%. In isolation, that's a pretty standard return but against the Chemicals industry average of 16%, it's not as good.

View our latest analysis for Southern Petrochemical Industries

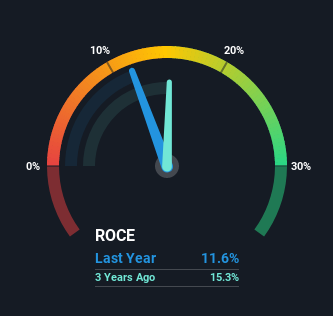

Historical performance is a great place to start when researching a stock so above you can see the gauge for Southern Petrochemical Industries' ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Southern Petrochemical Industries, check out these free graphs here.

What Can We Tell From Southern Petrochemical Industries' ROCE Trend?

When we looked at the ROCE trend at Southern Petrochemical Industries, we didn't gain much confidence. Over the last five years, returns on capital have decreased to 12% from 17% five years ago. Given the business is employing more capital while revenue has slipped, this is a bit concerning. This could mean that the business is losing its competitive advantage or market share, because while more money is being put into ventures, it's actually producing a lower return - "less bang for their buck" per se.

On a separate but related note, it's important to know that Southern Petrochemical Industries has a current liabilities to total assets ratio of 75%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

The Bottom Line

In summary, we're somewhat concerned by Southern Petrochemical Industries' diminishing returns on increasing amounts of capital. But investors must be expecting an improvement of sorts because over the last five yearsthe stock has delivered a respectable 64% return. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

One more thing to note, we've identified 1 warning sign with Southern Petrochemical Industries and understanding it should be part of your investment process.

While Southern Petrochemical Industries isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you’re looking to trade Southern Petrochemical Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SPIC

Southern Petrochemical Industries

Engages in the manufacture and sale of fertilizers in India and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives