- India

- /

- Metals and Mining

- /

- NSEI:SANDUMA

Sandur Manganese & Iron Ores' (NSE:SANDUMA) Sluggish Earnings Might Be Just The Beginning Of Its Problems

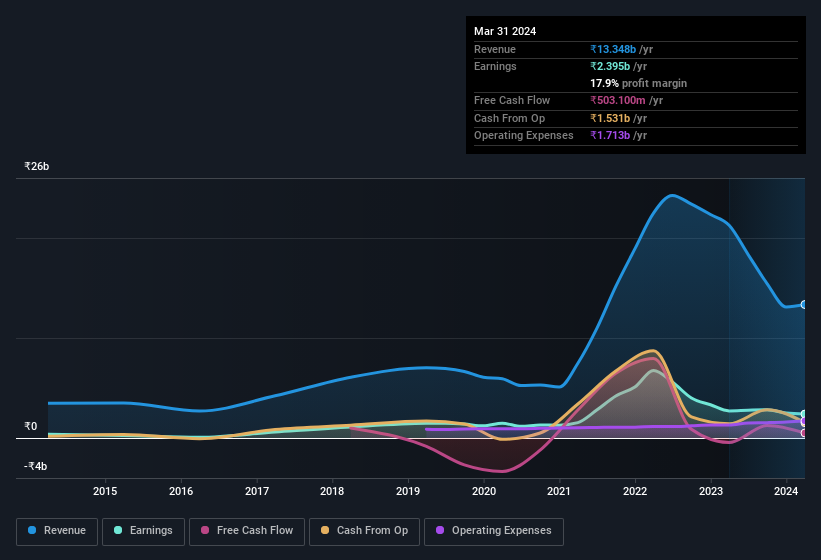

The market rallied behind The Sandur Manganese & Iron Ores Limited's (NSE:SANDUMA) stock, leading do a rise in the share price after its recent weak earnings report. Sometimes, shareholders are willing to ignore soft numbers with the hope that they will improve, but our analysis suggests this is unlikely for Sandur Manganese & Iron Ores.

Check out our latest analysis for Sandur Manganese & Iron Ores

The Power Of Non-Operating Revenue

At most companies, some revenue streams, such as government grants, are accounted for as non-operating revenue, while the core business is said to produce operating revenue. Oftentimes, non-operating revenue spikes are not repeated, so it makes sense to be cautious where non-operating revenue has made a very large contribution to total profit. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. Notably, Sandur Manganese & Iron Ores had a significant increase in non-operating revenue over the last year. In fact, our data indicates that non-operating revenue increased from ₹17.3m to ₹826.7m. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Sandur Manganese & Iron Ores.

Our Take On Sandur Manganese & Iron Ores' Profit Performance

As discussed above, Sandur Manganese & Iron Ores' sharp increase in non-operating revenue boosted its profit over the last year, and if that non-operating revenue is not repeated, then the trailing twelve months profit probably isn't as good as it seems. Therefore, it seems possible to us that Sandur Manganese & Iron Ores' true underlying earnings power is actually less than its statutory profit. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Just as investors must consider earnings, it is also important to take into account the strength of a company's balance sheet. We've done some analysis and you can see our take on Sandur Manganese & Iron Ores' balance sheet by clicking here.

Today we've zoomed in on a single data point to better understand the nature of Sandur Manganese & Iron Ores' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SANDUMA

Sandur Manganese & Iron Ores

Together with its subsidiary, engages in the mining of manganese and iron ores in Deogiri village of Ballari District, Karnataka.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives