- India

- /

- Basic Materials

- /

- NSEI:SAGCEM

Here's Why I Think Sagar Cements (NSE:SAGCEM) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Sagar Cements (NSE:SAGCEM), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Sagar Cements

Sagar Cements's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that Sagar Cements grew its EPS from ₹12.44 to ₹80.42, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

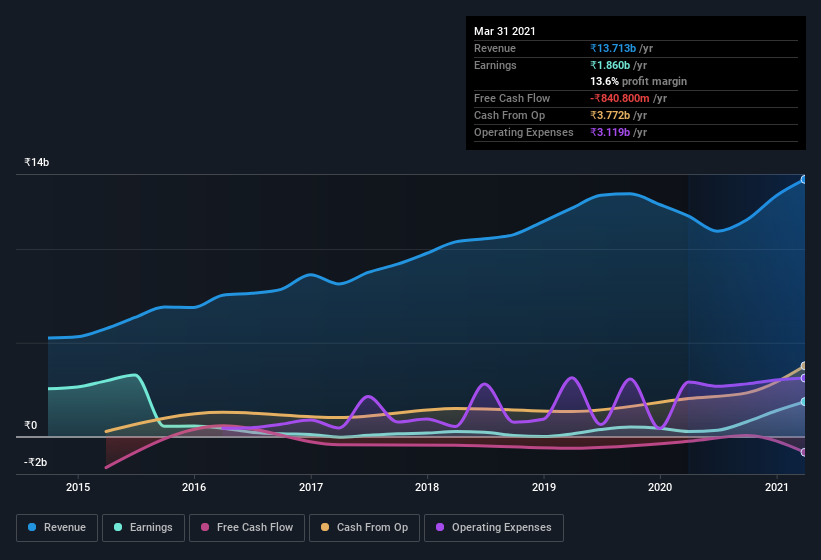

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that Sagar Cements is growing revenues, and EBIT margins improved by 14.1 percentage points to 23%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Sagar Cements's future profits.

Are Sagar Cements Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Insiders both bought and sold Sagar Cements shares in the last year, but the good news is they spent ₹2.3m more buying than they netted selling. When you weigh that up, it is a mild positive, indicating increased alignment between shareholders and management.

On top of the insider buying, we can also see that Sagar Cements insiders own a large chunk of the company. In fact, they own 50% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. And their holding is extremely valuable at the current share price, totalling ₹15b. Now that's what I call some serious skin in the game!

Should You Add Sagar Cements To Your Watchlist?

Sagar Cements's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Sagar Cements belongs on the top of your watchlist. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Sagar Cements that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Sagar Cements, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Sagar Cements or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SAGCEM

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives