- India

- /

- Metals and Mining

- /

- NSEI:RKFORGE

Should You Be Adding Ramkrishna Forgings (NSE:RKFORGE) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Ramkrishna Forgings (NSE:RKFORGE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Ramkrishna Forgings with the means to add long-term value to shareholders.

See our latest analysis for Ramkrishna Forgings

Ramkrishna Forgings' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, Ramkrishna Forgings has achieved impressive annual EPS growth of 56%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

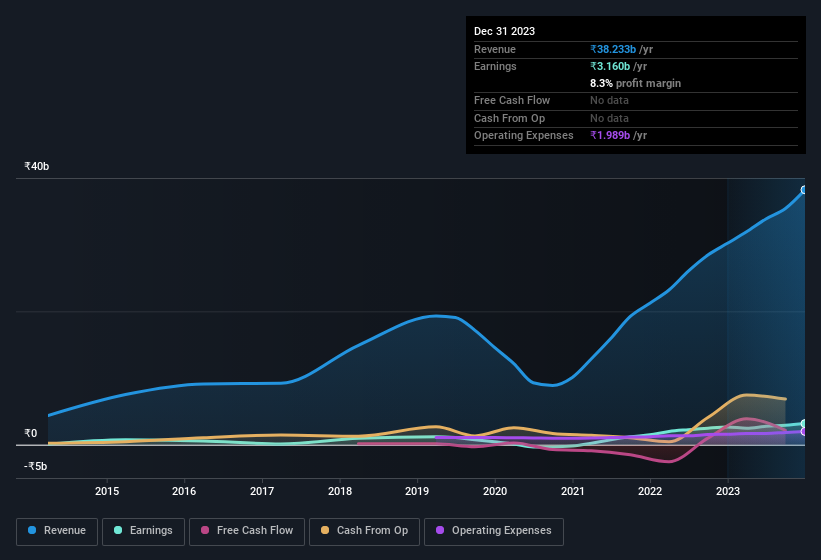

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Ramkrishna Forgings achieved similar EBIT margins to last year, revenue grew by a solid 27% to ₹38b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Ramkrishna Forgings' future EPS 100% free.

Are Ramkrishna Forgings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Ramkrishna Forgings top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the MD & Executive Director, Naresh Jalan, paid ₹4.2m to buy shares at an average price of ₹725. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

The good news, alongside the insider buying, for Ramkrishna Forgings bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth ₹16b. This totals to 13% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Looking very optimistic for investors.

Is Ramkrishna Forgings Worth Keeping An Eye On?

Ramkrishna Forgings' earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Ramkrishna Forgings deserves timely attention. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Ramkrishna Forgings that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Ramkrishna Forgings isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RKFORGE

Ramkrishna Forgings

Engages in the manufacture and sale of forged components for automobiles, railway wagons and coaches, and engineering parts in India and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion