Do Responsive Industries's (NSE:RESPONIND) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Responsive Industries (NSE:RESPONIND), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Responsive Industries

How Fast Is Responsive Industries Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, Responsive Industries's EPS has grown 29% each year, compound, over three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

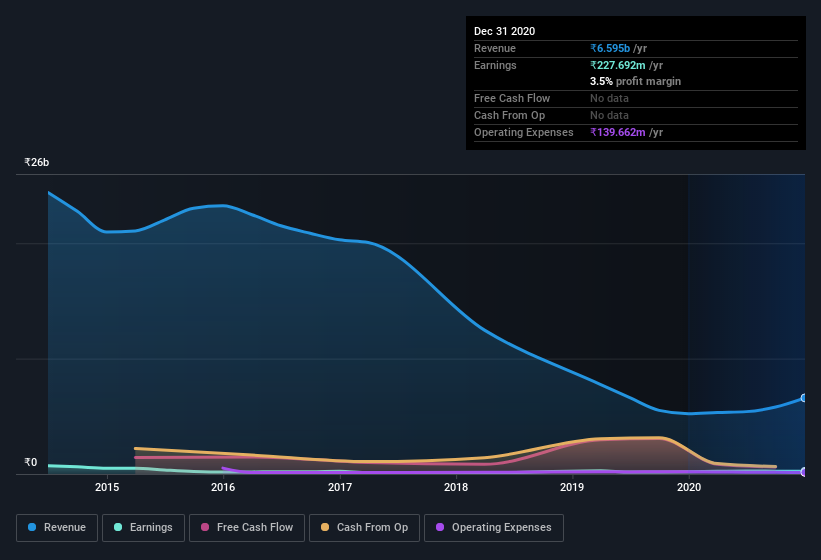

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Responsive Industries is growing revenues, and EBIT margins improved by 4.6 percentage points to 6.4%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Responsive Industries's balance sheet strength, before getting too excited.

Are Responsive Industries Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. I discovered that the median total compensation for the CEOs of companies like Responsive Industries with market caps between ₹15b and ₹59b is about ₹26m.

The CEO of Responsive Industries was paid just ₹2.2m in total compensation for the year ending . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Responsive Industries Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Responsive Industries's strong EPS growth. With swiftly growing earnings, it probably has its best days ahead, and the modest CEO pay suggests the company is careful with cash. So I'd argue this is the kind of stock worth watching, even if it isn't great value today. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Responsive Industries , and understanding it should be part of your investment process.

Although Responsive Industries certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Responsive Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:RESPONIND

Responsive Industries

Manufactures and sells polyvinyl chloride (PVC) based products in India.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026