- India

- /

- Basic Materials

- /

- NSEI:PRSMJOHNSN

Prism Johnson (NSE:PRSMJOHNSN) delivers shareholders impressive 23% CAGR over 5 years, surging 14% in the last week alone

Prism Johnson Limited (NSE:PRSMJOHNSN) shareholders might understandably be very concerned that the share price has dropped 33% in the last quarter. But that doesn't change the fact that the returns over the last five years have been very strong. In fact, the share price is 183% higher today. We think it's more important to dwell on the long term returns than the short term returns. Only time will tell if there is still too much optimism currently reflected in the share price.

The past week has proven to be lucrative for Prism Johnson investors, so let's see if fundamentals drove the company's five-year performance.

See our latest analysis for Prism Johnson

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Prism Johnson's earnings per share are down 1.9% per year, despite strong share price performance over five years.

By glancing at these numbers, we'd posit that the decline in earnings per share is not representative of how the business has changed over the years. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In contrast revenue growth of 7.4% per year is probably viewed as evidence that Prism Johnson is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

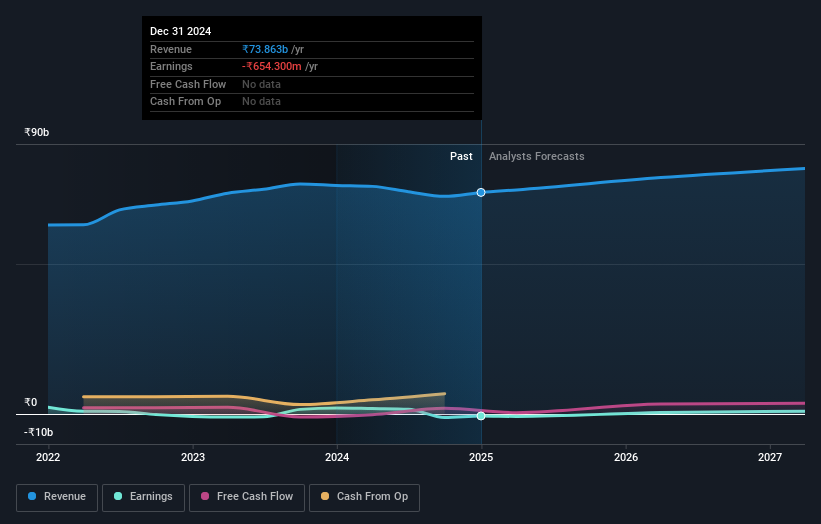

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Prism Johnson stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 1.1% in the twelve months, Prism Johnson shareholders did even worse, losing 24%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 23% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Prism Johnson , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PRSMJOHNSN

Prism Johnson

An integrated building materials company, manufactures and sells cement, tiles, and ready-mixed concrete in India and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026