- India

- /

- Basic Materials

- /

- NSEI:PRSMJOHNSN

Investors Continue Waiting On Sidelines For Prism Johnson Limited (NSE:PRSMJOHNSN)

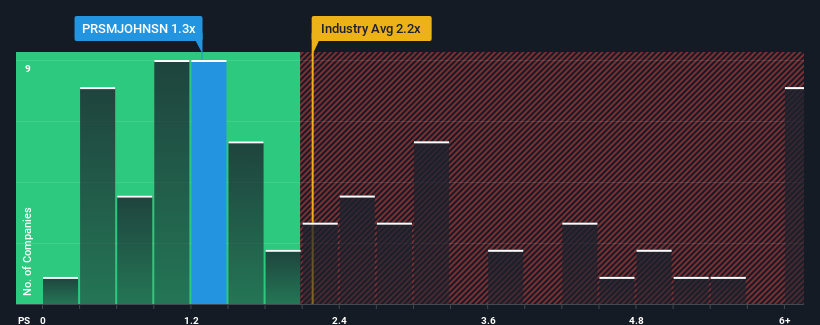

Prism Johnson Limited's (NSE:PRSMJOHNSN) price-to-sales (or "P/S") ratio of 1.3x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Basic Materials industry in India have P/S ratios greater than 2.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Prism Johnson

What Does Prism Johnson's P/S Mean For Shareholders?

Prism Johnson hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Prism Johnson's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Prism Johnson would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 5.3% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 17% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 7.6% as estimated by the four analysts watching the company. That would be an excellent outcome when the industry is expected to decline by 3.9%.

With this in mind, we find it intriguing that Prism Johnson's P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

What Does Prism Johnson's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Prism Johnson's analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for Prism Johnson that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PRSMJOHNSN

Prism Johnson

An integrated building materials company, manufactures and sells cement, tiles, and ready-mixed concrete in India and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives