- India

- /

- Basic Materials

- /

- NSEI:POKARNA

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Pokarna Limited's (NSE:POKARNA) CEO For Now

Key Insights

- Pokarna will host its Annual General Meeting on 18th of September

- CEO Gautam Chand Jain's total compensation includes salary of ₹18.0m

- Total compensation is 81% above industry average

- Pokarna's EPS grew by 21% over the past three years while total shareholder return over the past three years was 323%

CEO Gautam Chand Jain has done a decent job of delivering relatively good performance at Pokarna Limited (NSE:POKARNA) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 18th of September. However, some shareholders may still want to keep CEO compensation within reason.

Check out our latest analysis for Pokarna

Comparing Pokarna Limited's CEO Compensation With The Industry

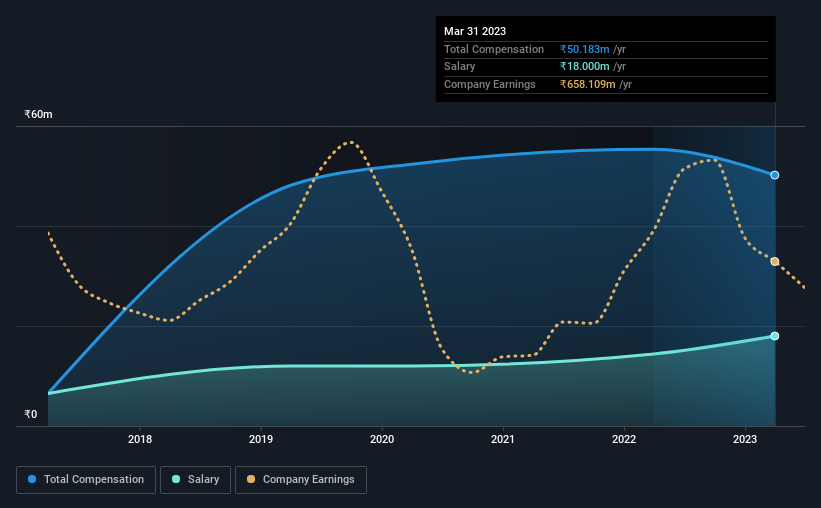

Our data indicates that Pokarna Limited has a market capitalization of ₹17b, and total annual CEO compensation was reported as ₹50m for the year to March 2023. Notably, that's a decrease of 9.3% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at ₹18m.

On comparing similar companies from the Indian Basic Materials industry with market caps ranging from ₹8.3b to ₹33b, we found that the median CEO total compensation was ₹28m. Accordingly, our analysis reveals that Pokarna Limited pays Gautam Chand Jain north of the industry median. Furthermore, Gautam Chand Jain directly owns ₹8.9b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹18m | ₹14m | 36% |

| Other | ₹32m | ₹41m | 64% |

| Total Compensation | ₹50m | ₹55m | 100% |

Talking in terms of the industry, salary represented approximately 86% of total compensation out of all the companies we analyzed, while other remuneration made up 14% of the pie. In Pokarna's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Pokarna Limited's Growth Numbers

Pokarna Limited has seen its earnings per share (EPS) increase by 21% a year over the past three years. It saw its revenue drop 17% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Pokarna Limited Been A Good Investment?

Boasting a total shareholder return of 323% over three years, Pokarna Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 4 warning signs for Pokarna you should be aware of, and 2 of them shouldn't be ignored.

Important note: Pokarna is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:POKARNA

Pokarna

Engages in quarrying, manufacture, processing, and sale of granites in India.

Solid track record with excellent balance sheet.