Panama Petrochem Limited (NSE:PANAMAPET) Held Back By Insufficient Growth Even After Shares Climb 27%

Panama Petrochem Limited (NSE:PANAMAPET) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 23% is also fairly reasonable.

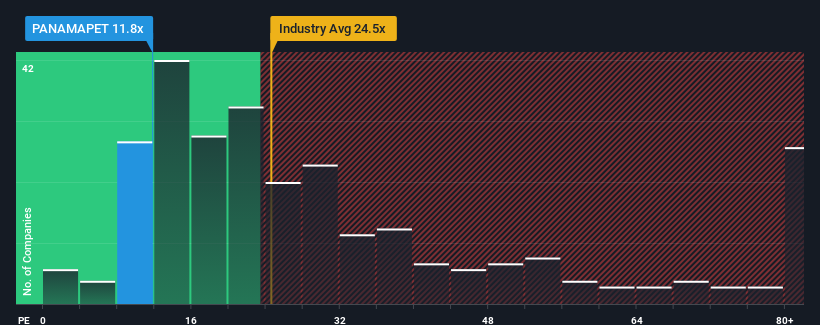

Even after such a large jump in price, Panama Petrochem may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.8x, since almost half of all companies in India have P/E ratios greater than 26x and even P/E's higher than 49x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

The earnings growth achieved at Panama Petrochem over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Panama Petrochem

How Is Panama Petrochem's Growth Trending?

In order to justify its P/E ratio, Panama Petrochem would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 10%. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 13% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 25% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Panama Petrochem's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Final Word

Panama Petrochem's recent share price jump still sees its P/E sitting firmly flat on the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Panama Petrochem maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Panama Petrochem that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PANAMAPET

Panama Petrochem

Manufactures and sells specialty petroleum products for printing, textile, rubber, pharmaceutical, cosmetic, power, and other industrial oil industries in India and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives