Despite the downward trend in earnings at Oriental Aromatics (NSE:OAL) the stock hikes 11%, bringing three-year gains to 181%

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. For instance the Oriental Aromatics Limited (NSE:OAL) share price is 179% higher than it was three years ago. How nice for those who held the stock! And in the last week the share price has popped 11%.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Check out our latest analysis for Oriental Aromatics

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

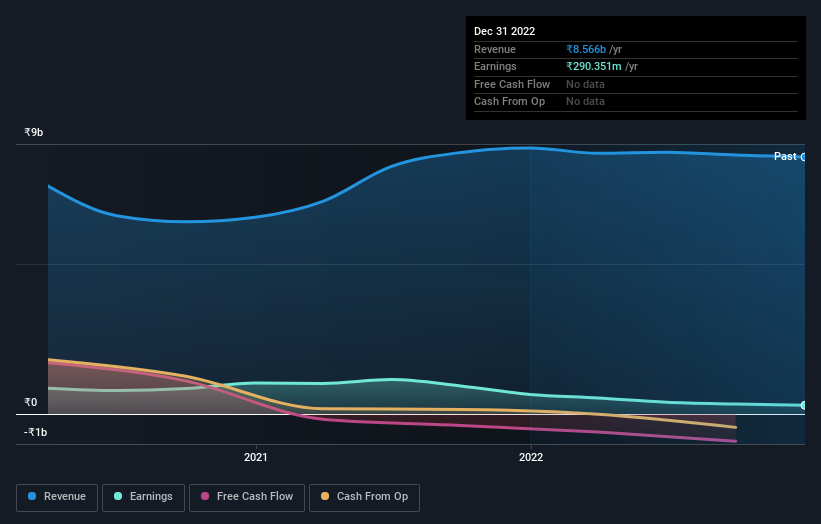

During the three years of share price growth, Oriental Aromatics actually saw its earnings per share (EPS) drop 30% per year.

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Therefore, we think it's worth considering other metrics as well.

Languishing at just 0.4%, we doubt the dividend is doing much to prop up the share price. It may well be that Oriental Aromatics revenue growth rate of 11% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Oriental Aromatics' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Oriental Aromatics shareholders are down 48% for the year (even including dividends), falling short of the market return. The market shed around 1.4%, no doubt weighing on the stock price. Fortunately the longer term story is brighter, with total returns averaging about 41% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Oriental Aromatics you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

If you're looking to trade Oriental Aromatics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:OAL

Oriental Aromatics

Manufactures and sells terpene chemicals, camphor, and other specialty aroma Ingredients in India.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives