Analyst Forecasts Just Became More Bearish On Mold-Tek Packaging Limited (NSE:MOLDTKPAC)

Today is shaping up negative for Mold-Tek Packaging Limited (NSE:MOLDTKPAC) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

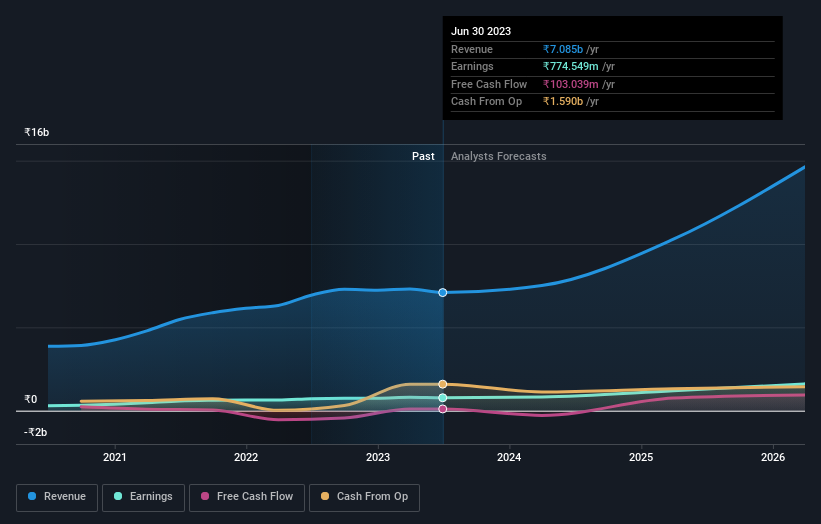

After this downgrade, Mold-Tek Packaging's ten analysts are now forecasting revenues of ₹7.5b in 2024. This would be a modest 5.9% improvement in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing ₹8.6b of revenue in 2024. It looks like forecasts have become a fair bit less optimistic on Mold-Tek Packaging, given the measurable cut to revenue estimates.

Check out our latest analysis for Mold-Tek Packaging

There was no particular change to the consensus price target of ₹1,104, with Mold-Tek Packaging's latest outlook seemingly not enough to result in a change of valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Mold-Tek Packaging analyst has a price target of ₹1,300 per share, while the most pessimistic values it at ₹950. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Mold-Tek Packaging shareholders.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's pretty clear that there is an expectation that Mold-Tek Packaging's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 8.0% growth on an annualised basis. This is compared to a historical growth rate of 16% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 13% per year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Mold-Tek Packaging.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Mold-Tek Packaging this year. They're also anticipating slower revenue growth than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Mold-Tek Packaging after today.

Looking to learn more? We have estimates for Mold-Tek Packaging from its ten analysts out until 2026, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MOLDTKPAC

Mold-Tek Packaging

Engages in the manufacture and sale of plastic packaging containers in India.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion