Mayur Uniquoters (NSE:MAYURUNIQ) Ticks All The Boxes When It Comes To Earnings Growth

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Mayur Uniquoters (NSE:MAYURUNIQ). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Mayur Uniquoters

How Fast Is Mayur Uniquoters Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Mayur Uniquoters has grown EPS by 10% per year. That growth rate is fairly good, assuming the company can keep it up.

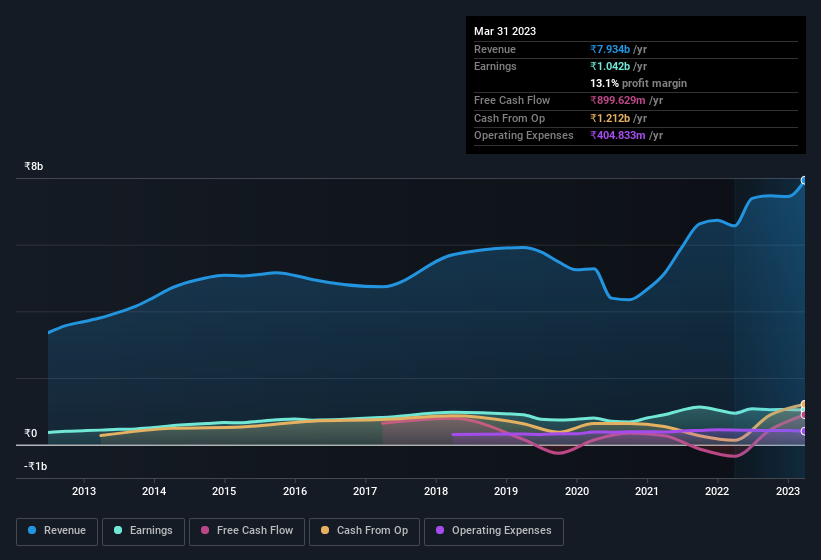

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Mayur Uniquoters maintained stable EBIT margins over the last year, all while growing revenue 21% to ₹7.9b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Mayur Uniquoters isn't a huge company, given its market capitalisation of ₹21b. That makes it extra important to check on its balance sheet strength.

Are Mayur Uniquoters Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that Mayur Uniquoters insiders own a meaningful share of the business. In fact, they own 59% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. To give you an idea, the value of insiders' holdings in the business are valued at ₹12b at the current share price. That's nothing to sneeze at!

Is Mayur Uniquoters Worth Keeping An Eye On?

One important encouraging feature of Mayur Uniquoters is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. Still, you should learn about the 1 warning sign we've spotted with Mayur Uniquoters.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAYURUNIQ

Mayur Uniquoters

Engages in the manufacture and sale of coated textile fabrics in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026