- India

- /

- Metals and Mining

- /

- NSEI:MAHSEAMLES

Does Maharashtra Seamless (NSE:MAHSEAMLES) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Maharashtra Seamless (NSE:MAHSEAMLES), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Maharashtra Seamless

Maharashtra Seamless' Improving Profits

In the last three years Maharashtra Seamless' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Maharashtra Seamless boosted its trailing twelve month EPS from ₹57.07 to ₹70.99, in the last year. That's a 24% gain; respectable growth in the broader scheme of things.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. We note that while EBIT margins have improved from 16% to 21%, the company has actually reported a fall in revenue by 5.5%. While not disastrous, these figures could be better.

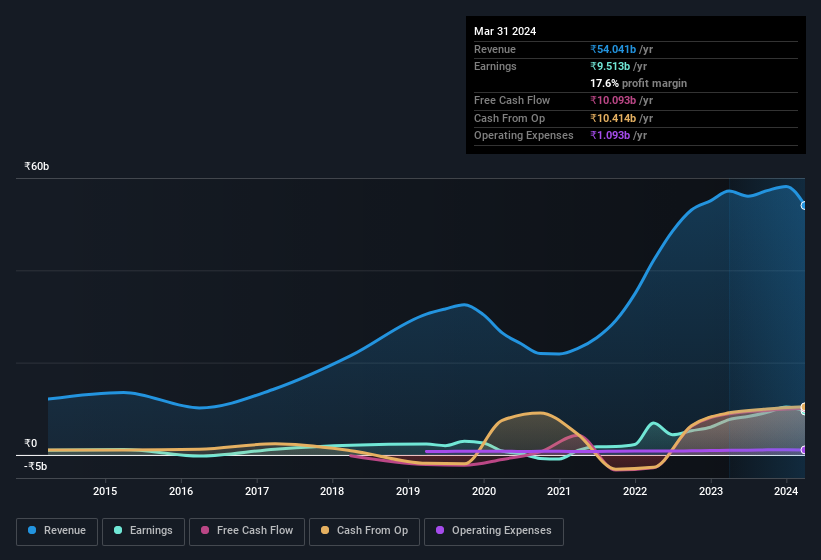

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Maharashtra Seamless' balance sheet strength, before getting too excited.

Are Maharashtra Seamless Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The first bit of good news is that no Maharashtra Seamless insiders reported share sales in the last twelve months. Even better, though, is that the Non-Executive Chairman, Dharam Jindal, bought a whopping ₹37m worth of shares, paying about ₹712 per share, on average. Big buys like that may signal an opportunity; actions speak louder than words.

The good news, alongside the insider buying, for Maharashtra Seamless bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enviable stake in the company, worth ₹9.4b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Is Maharashtra Seamless Worth Keeping An Eye On?

One positive for Maharashtra Seamless is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Before you take the next step you should know about the 1 warning sign for Maharashtra Seamless that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Maharashtra Seamless, you'll probably love this curated collection of companies in IN that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAHSEAMLES

Maharashtra Seamless

Engages in the manufacture and sale of seamless steel pipes and tubes in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026