Here's Why Krishana Phoschem (NSE:KRISHANA) Can Manage Its Debt Responsibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Krishana Phoschem Limited (NSE:KRISHANA) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Krishana Phoschem

What Is Krishana Phoschem's Net Debt?

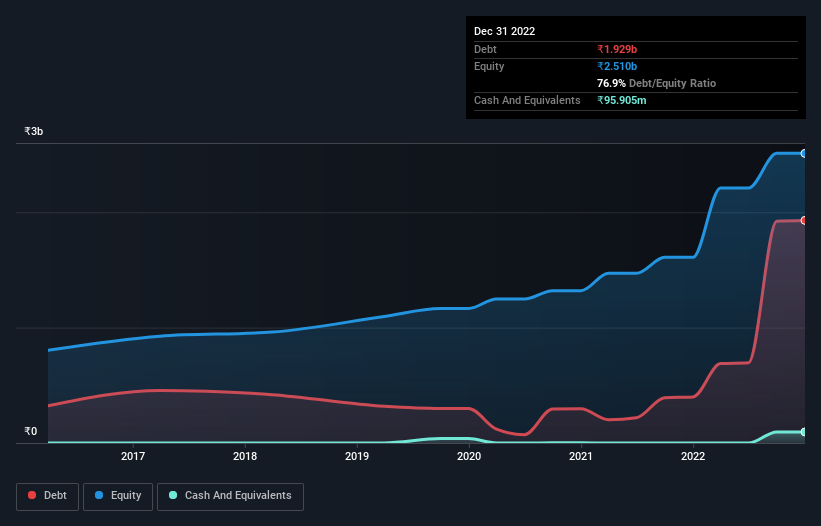

You can click the graphic below for the historical numbers, but it shows that as of September 2022 Krishana Phoschem had ₹1.93b of debt, an increase on ₹399.6m, over one year. However, because it has a cash reserve of ₹95.9m, its net debt is less, at about ₹1.83b.

A Look At Krishana Phoschem's Liabilities

Zooming in on the latest balance sheet data, we can see that Krishana Phoschem had liabilities of ₹897.0m due within 12 months and liabilities of ₹1.35b due beyond that. On the other hand, it had cash of ₹95.9m and ₹941.2m worth of receivables due within a year. So it has liabilities totalling ₹1.21b more than its cash and near-term receivables, combined.

Since publicly traded Krishana Phoschem shares are worth a total of ₹15.8b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Krishana Phoschem has a debt to EBITDA ratio of 3.4, which signals significant debt, but is still pretty reasonable for most types of business. However, its interest coverage of 16.5 is very high, suggesting that the interest expense on the debt is currently quite low. Also relevant is that Krishana Phoschem has grown its EBIT by a very respectable 30% in the last year, thus enhancing its ability to pay down debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Krishana Phoschem will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Krishana Phoschem burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Based on what we've seen Krishana Phoschem is not finding it easy, given its conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to cover its interest expense with its EBIT is pretty flash. When we consider all the elements mentioned above, it seems to us that Krishana Phoschem is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Krishana Phoschem is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Krishana Phoschem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KRISHANA

Krishana Phoschem

Engages in the manufacture and sale of fertilizers and chemicals under the Annadata and Bharat brands in India.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives