Does Kiri Industries (NSE:KIRIINDUS) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Kiri Industries Limited (NSE:KIRIINDUS) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Kiri Industries

What Is Kiri Industries's Debt?

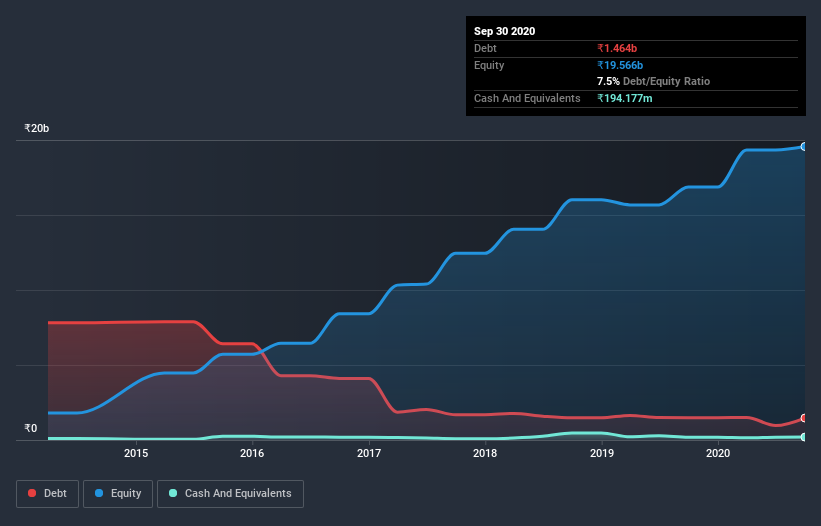

The chart below, which you can click on for greater detail, shows that Kiri Industries had ₹1.46b in debt in September 2020; about the same as the year before. However, because it has a cash reserve of ₹194.2m, its net debt is less, at about ₹1.27b.

How Healthy Is Kiri Industries's Balance Sheet?

According to the last reported balance sheet, Kiri Industries had liabilities of ₹3.24b due within 12 months, and liabilities of ₹1.69b due beyond 12 months. On the other hand, it had cash of ₹194.2m and ₹3.06b worth of receivables due within a year. So its liabilities total ₹1.68b more than the combination of its cash and short-term receivables.

Of course, Kiri Industries has a market capitalization of ₹15.3b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

We'd say that Kiri Industries's moderate net debt to EBITDA ratio ( being 1.8), indicates prudence when it comes to debt. And its strong interest cover of 1k times, makes us even more comfortable. Shareholders should be aware that Kiri Industries's EBIT was down 84% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. There's no doubt that we learn most about debt from the balance sheet. But it is Kiri Industries's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Kiri Industries created free cash flow amounting to 6.3% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Kiri Industries's EBIT growth rate and conversion of EBIT to free cash flow definitely weigh on it, in our esteem. But its interest cover tells a very different story, and suggests some resilience. When we consider all the factors discussed, it seems to us that Kiri Industries is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. Over time, share prices tend to follow earnings per share, so if you're interested in Kiri Industries, you may well want to click here to check an interactive graph of its earnings per share history.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Kiri Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kiri Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:KIRIINDUS

Kiri Industries

Manufactures and sells dyes, dye intermediates, and basic chemicals in India and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives