Kanpur Plastipack's (NSE:KANPRPLA) Performance Is Even Better Than Its Earnings Suggest

When companies post strong earnings, the stock generally performs well, just like Kanpur Plastipack Limited's (NSE:KANPRPLA) stock has recently. We did some digging and found some further encouraging factors that investors will like.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, Kanpur Plastipack increased the number of shares on issue by 8.2% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Kanpur Plastipack's historical EPS growth by clicking on this link.

A Look At The Impact Of Kanpur Plastipack's Dilution On Its Earnings Per Share (EPS)

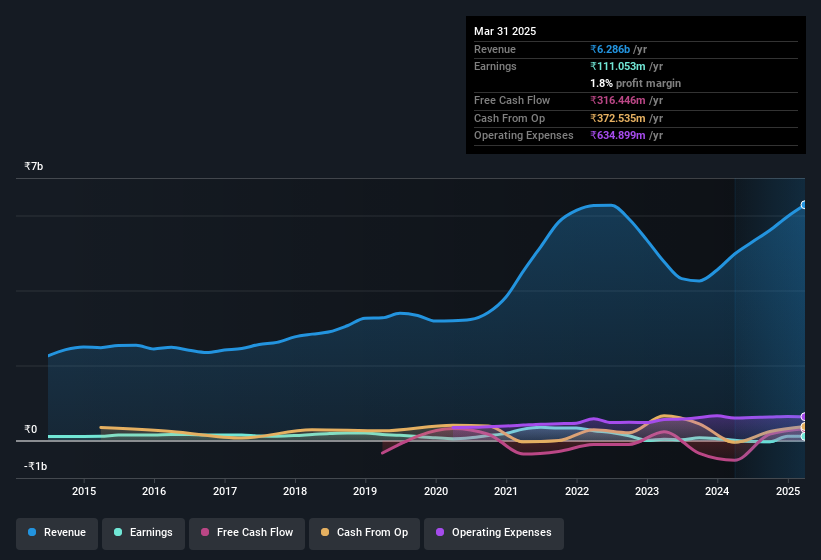

Kanpur Plastipack's net profit dropped by 58% per year over the last three years. On the bright side, in the last twelve months it grew profit by 1,276%. On the other hand, earnings per share are only up 1,259% over the same period. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So Kanpur Plastipack shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Kanpur Plastipack.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that Kanpur Plastipack's profit suffered from unusual items, which reduced profit by ₹116m in the last twelve months. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect Kanpur Plastipack to produce a higher profit next year, all else being equal.

Our Take On Kanpur Plastipack's Profit Performance

Kanpur Plastipack suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But unfortunately the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). That will weigh on earnings per share, even if it is not reflected in net income. Based on these factors, we think that Kanpur Plastipack's profits are a reasonably conservative guide to its underlying profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've found that Kanpur Plastipack has 6 warning signs (2 are concerning!) that deserve your attention before going any further with your analysis.

Our examination of Kanpur Plastipack has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Kanpur Plastipack might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KANPRPLA

Kanpur Plastipack

Manufactures and trades in industrial packaging solutions in India and internationally.

Medium-low with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives