Kanpur Plastipack Limited's (NSE:KANPRPLA) Price Is Right But Growth Is Lacking After Shares Rocket 37%

Kanpur Plastipack Limited (NSE:KANPRPLA) shareholders would be excited to see that the share price has had a great month, posting a 37% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

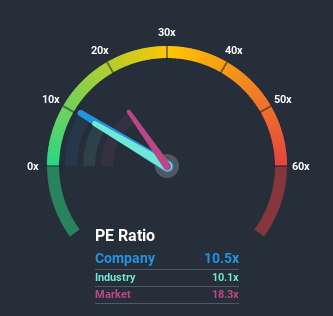

Although its price has surged higher, Kanpur Plastipack's price-to-earnings (or "P/E") ratio of 10.5x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 19x and even P/E's above 42x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Kanpur Plastipack as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Kanpur Plastipack

Is There Any Growth For Kanpur Plastipack?

Kanpur Plastipack's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 163%. As a result, it also grew EPS by 21% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 29% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Kanpur Plastipack's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

Despite Kanpur Plastipack's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Kanpur Plastipack maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 5 warning signs for Kanpur Plastipack (1 is a bit unpleasant!) that we have uncovered.

If these risks are making you reconsider your opinion on Kanpur Plastipack, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you’re looking to trade Kanpur Plastipack, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Kanpur Plastipack, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kanpur Plastipack might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:KANPRPLA

Kanpur Plastipack

Manufactures and trades in industrial packaging solutions in India and internationally.

Medium-low with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives