It's Unlikely That Kanpur Plastipack Limited's (NSE:KANPRPLA) CEO Will See A Huge Pay Rise This Year

Key Insights

- Kanpur Plastipack to hold its Annual General Meeting on 20th of September

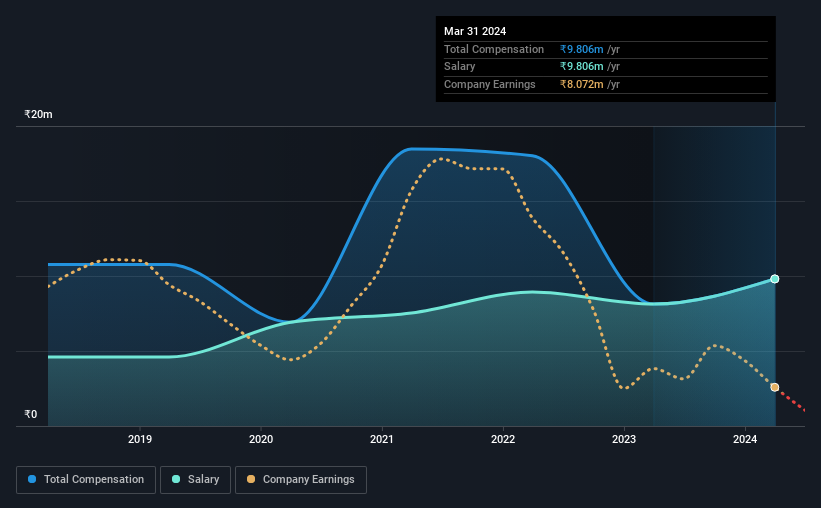

- Salary of ₹9.81m is part of CEO Manoj Agarwal's total remuneration

- The overall pay is 171% above the industry average

- Over the past three years, Kanpur Plastipack's EPS fell by 103% and over the past three years, the total loss to shareholders 28%

Shareholders of Kanpur Plastipack Limited (NSE:KANPRPLA) will have been dismayed by the negative share price return over the last three years. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 20th of September, where they can impact on future company performance by voting on resolutions, including executive compensation. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

View our latest analysis for Kanpur Plastipack

How Does Total Compensation For Manoj Agarwal Compare With Other Companies In The Industry?

At the time of writing, our data shows that Kanpur Plastipack Limited has a market capitalization of ₹2.7b, and reported total annual CEO compensation of ₹9.8m for the year to March 2024. That's a notable increase of 21% on last year. Notably, the salary of ₹9.8m is the entirety of the CEO compensation.

For comparison, other companies in the Indian Packaging industry with market capitalizations below ₹17b, reported a median total CEO compensation of ₹3.6m. Hence, we can conclude that Manoj Agarwal is remunerated higher than the industry median. Furthermore, Manoj Agarwal directly owns ₹274m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹9.8m | ₹8.1m | 100% |

| Other | - | - | - |

| Total Compensation | ₹9.8m | ₹8.1m | 100% |

On an industry level, it's fascinating to see that all of total compensation represents salary and non-salary benefits do not factor into the equation at all. Speaking on a company level, Kanpur Plastipack prefers to tread along a traditional path, disbursing all compensation through a salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Kanpur Plastipack Limited's Growth

Kanpur Plastipack Limited has reduced its earnings per share by 103% a year over the last three years. It achieved revenue growth of 23% over the last year.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Kanpur Plastipack Limited Been A Good Investment?

Since shareholders would have lost about 28% over three years, some Kanpur Plastipack Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Kanpur Plastipack pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 3 warning signs (and 2 which don't sit too well with us) in Kanpur Plastipack we think you should know about.

Switching gears from Kanpur Plastipack, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Kanpur Plastipack might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KANPRPLA

Kanpur Plastipack

Manufactures and trades in industrial packaging solutions in India and internationally.

Medium-low with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives