India Glycols Limited's (NSE:INDIAGLYCO) Stock Is Going Strong: Have Financials A Role To Play?

India Glycols (NSE:INDIAGLYCO) has had a great run on the share market with its stock up by a significant 12% over the last month. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. In this article, we decided to focus on India Glycols' ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for India Glycols

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for India Glycols is:

9.1% = ₹1.9b ÷ ₹21b (Based on the trailing twelve months to September 2024).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each ₹1 of shareholders' capital it has, the company made ₹0.09 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of India Glycols' Earnings Growth And 9.1% ROE

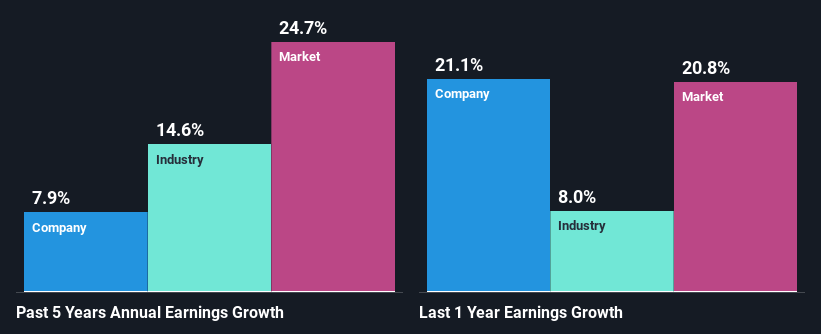

When you first look at it, India Glycols' ROE doesn't look that attractive. However, its ROE is similar to the industry average of 10%, so we won't completely dismiss the company. On the other hand, India Glycols reported a moderate 7.9% net income growth over the past five years. Considering the moderately low ROE, it is quite possible that there might be some other aspects that are positively influencing the company's earnings growth. Such as - high earnings retention or an efficient management in place.

We then compared India Glycols' net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 15% in the same 5-year period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Is India Glycols fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is India Glycols Using Its Retained Earnings Effectively?

India Glycols has a low three-year median payout ratio of 14%, meaning that the company retains the remaining 86% of its profits. This suggests that the management is reinvesting most of the profits to grow the business.

Moreover, India Glycols is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Conclusion

On the whole, we do feel that India Glycols has some positive attributes. Namely, its respectable earnings growth, which it achieved due to it retaining most of its profits. However, given the low ROE, investors may not be benefitting from all that reinvestment after all. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. You can see the 3 risks we have identified for India Glycols by visiting our risks dashboard for free on our platform here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDIAGLYCO

India Glycols

A green petrochemical company, engages in the manufacture and sale of industrial chemicals in India.

Proven track record with mediocre balance sheet.