- India

- /

- Basic Materials

- /

- NSEI:IFGLEXPOR

Investors Give IFGL Refractories Limited (NSE:IFGLEXPOR) Shares A 26% Hiding

IFGL Refractories Limited (NSE:IFGLEXPOR) shares have had a horrible month, losing 26% after a relatively good period beforehand. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 127% in the last twelve months.

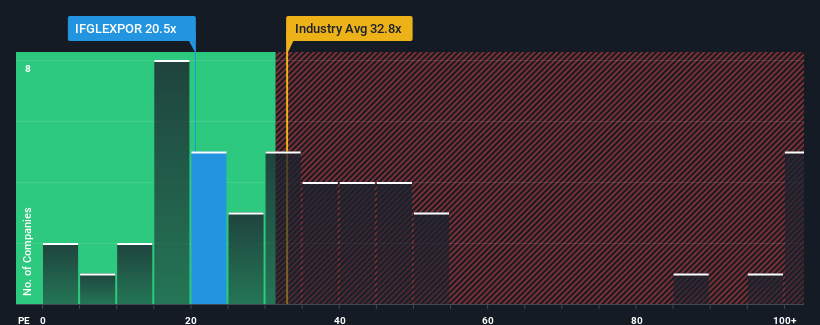

Even after such a large drop in price, IFGL Refractories' price-to-earnings (or "P/E") ratio of 20.5x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 31x and even P/E's above 58x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

IFGL Refractories certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for IFGL Refractories

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, IFGL Refractories would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 40%. The latest three year period has also seen an excellent 82% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 39% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 25% growth forecast for the broader market.

In light of this, it's peculiar that IFGL Refractories' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

IFGL Refractories' P/E has taken a tumble along with its share price. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that IFGL Refractories currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It is also worth noting that we have found 2 warning signs for IFGL Refractories that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade IFGL Refractories, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IFGLEXPOR

IFGL Refractories

Engages in the manufacturing, trading, and selling of refractory items and related equipment and accessories used in steel plants in India and internationally.

Excellent balance sheet and good value.