- India

- /

- Metals and Mining

- /

- NSEI:HINDCOPPER

We Ran A Stock Scan For Earnings Growth And Hindustan Copper (NSE:HINDCOPPER) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hindustan Copper (NSE:HINDCOPPER). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Hindustan Copper with the means to add long-term value to shareholders.

View our latest analysis for Hindustan Copper

Hindustan Copper's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Hindustan Copper's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 48%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

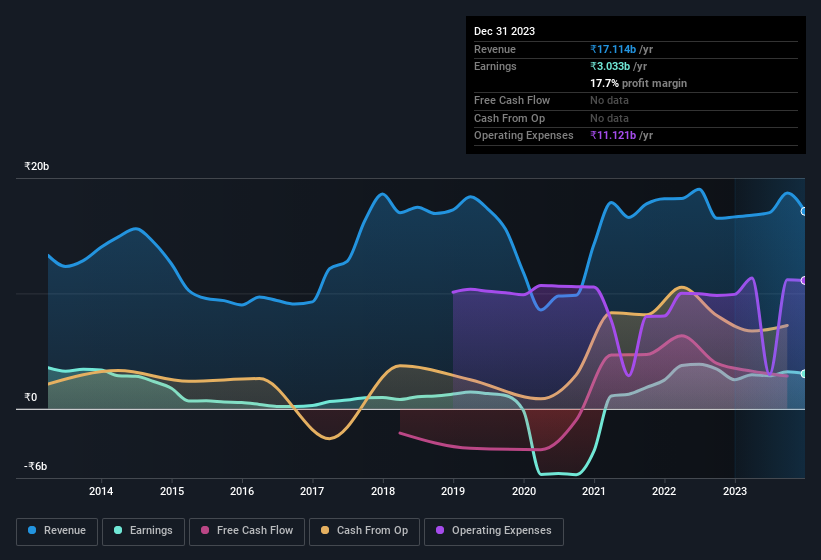

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Hindustan Copper maintained stable EBIT margins over the last year, all while growing revenue 2.9% to ₹17b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Hindustan Copper Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. The median total compensation for CEOs of companies similar in size to Hindustan Copper, with market caps between ₹166b and ₹530b, is around ₹44m.

The Hindustan Copper CEO received total compensation of only ₹420k in the year to March 2023. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Hindustan Copper Worth Keeping An Eye On?

Hindustan Copper's earnings per share growth have been climbing higher at an appreciable rate. This appreciable increase in earnings could be a sign of an upward trajectory for the company. Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. So faced with these facts, it seems that researching this stock a little more may lead you to discover an investment opportunity that meets your quality standards. It is worth noting though that we have found 2 warning signs for Hindustan Copper that you need to take into consideration.

Although Hindustan Copper certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Indian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Copper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HINDCOPPER

Hindustan Copper

Engages in the exploration, exploitation, and mining of copper and copper ores in India.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives