In the last week, the Indian market has been flat, yet it has seen a remarkable 40% increase over the past year, with earnings forecasted to grow by 17% annually. In this dynamic environment, dividend stocks can offer investors a steady income stream and potential for capital appreciation, making them an attractive consideration for portfolio diversification.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.69% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 4.82% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 3.89% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.74% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.74% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.55% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.44% | ★★★★★☆ |

| Canara Bank (NSEI:CANBK) | 3.13% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 4.32% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.09% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Indian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Bank of Baroda (NSEI:BANKBARODA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Baroda Limited offers a range of banking products and services to individuals, government departments, and corporate customers both in India and internationally, with a market cap of ₹1.27 trillion.

Operations: Bank of Baroda Limited's revenue is primarily derived from its Treasury segment at ₹316.82 billion, Corporate/Wholesale Banking at ₹502.78 billion, and Retail Banking (including Digital and Other Retail Banking) at ₹512.25 billion, along with Other Banking Operations contributing ₹110.76 billion.

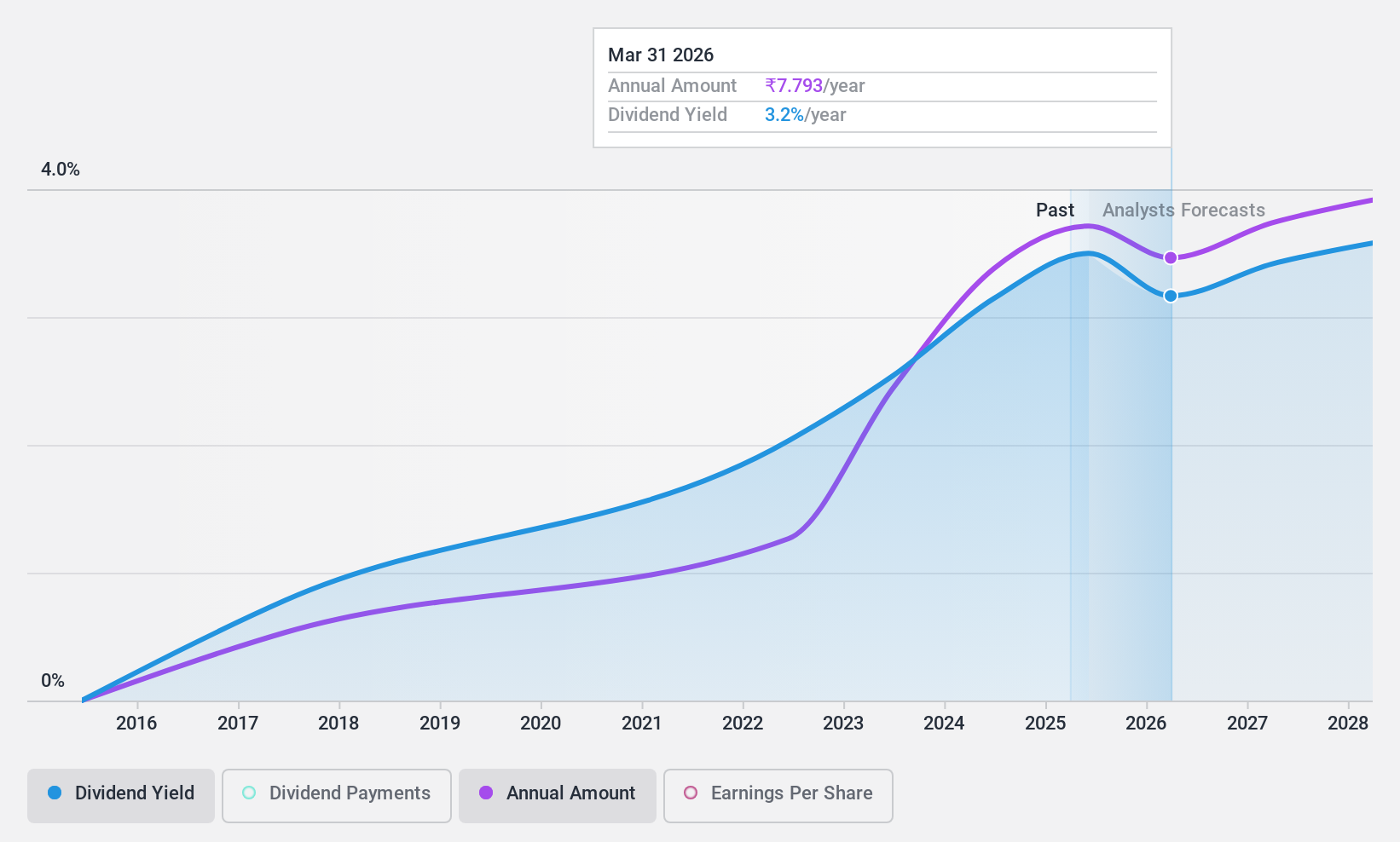

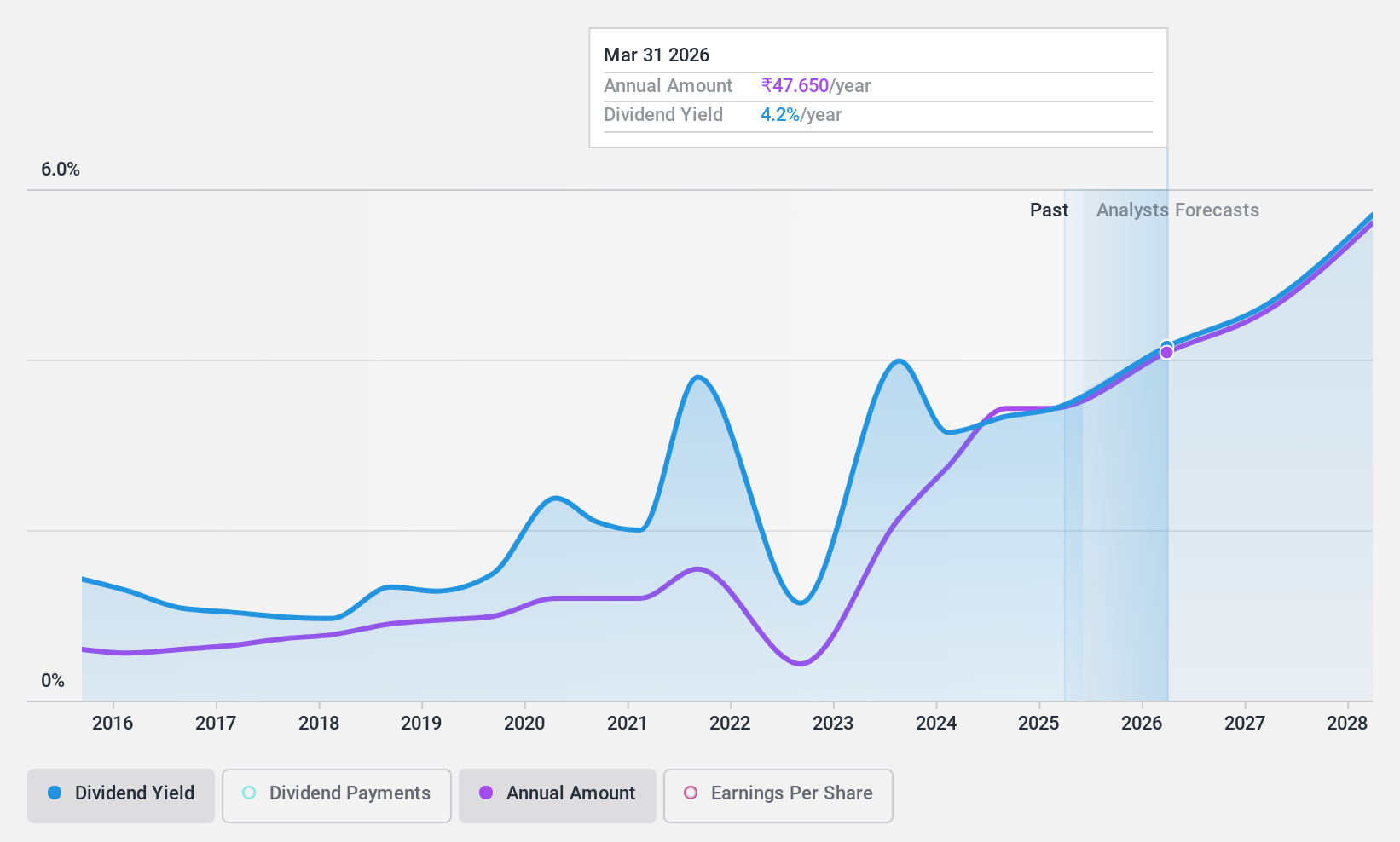

Dividend Yield: 3.1%

Bank of Baroda's dividend payments, with a payout ratio of 20.9%, are well-covered by earnings and forecasted to remain so in three years. However, its dividend history has been volatile over the past decade, despite recent growth. The bank's current dividend yield is among the top 25% in India at 3.09%. Recent strategic initiatives like the co-branded travel debit card could enhance customer engagement and potentially impact future financial performance positively.

- Click here to discover the nuances of Bank of Baroda with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Bank of Baroda's current price could be quite moderate.

Gulf Oil Lubricants India (NSEI:GULFOILLUB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gulf Oil Lubricants India Limited is engaged in the manufacture, marketing, and trading of lubricating oils, greases, and other derivatives for the automobile and industrial sectors in India with a market cap of ₹63.12 billion.

Operations: The company's revenue is derived from its lubricants segment, which generated ₹33.83 billion.

Dividend Yield: 3.2%

Gulf Oil Lubricants India's dividend is supported by a payout ratio of 57.4%, indicating sustainability from earnings and cash flows, though its dividend history has been volatile over the past decade. With a yield of 3.2%, it ranks in the top 25% among Indian dividend payers. Recent board changes, including appointing Mr. Abhijit Kulkarni as Senior Management Personnel, may influence future growth strategies, potentially impacting dividend stability and company performance positively.

- Click to explore a detailed breakdown of our findings in Gulf Oil Lubricants India's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Gulf Oil Lubricants India shares in the market.

Uniparts India (NSEI:UNIPARTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Uniparts India Limited, along with its subsidiaries, manufactures and sells engineering systems, solutions, and assemblies primarily for off-highway vehicles across various international markets including India, the United States, Asia Pacific, Europe, and Japan; it has a market cap of ₹20.41 billion.

Operations: Uniparts India Limited generates revenue primarily from its Linkage Parts and Components for Off-Highway Vehicles segment, amounting to ₹11.04 billion.

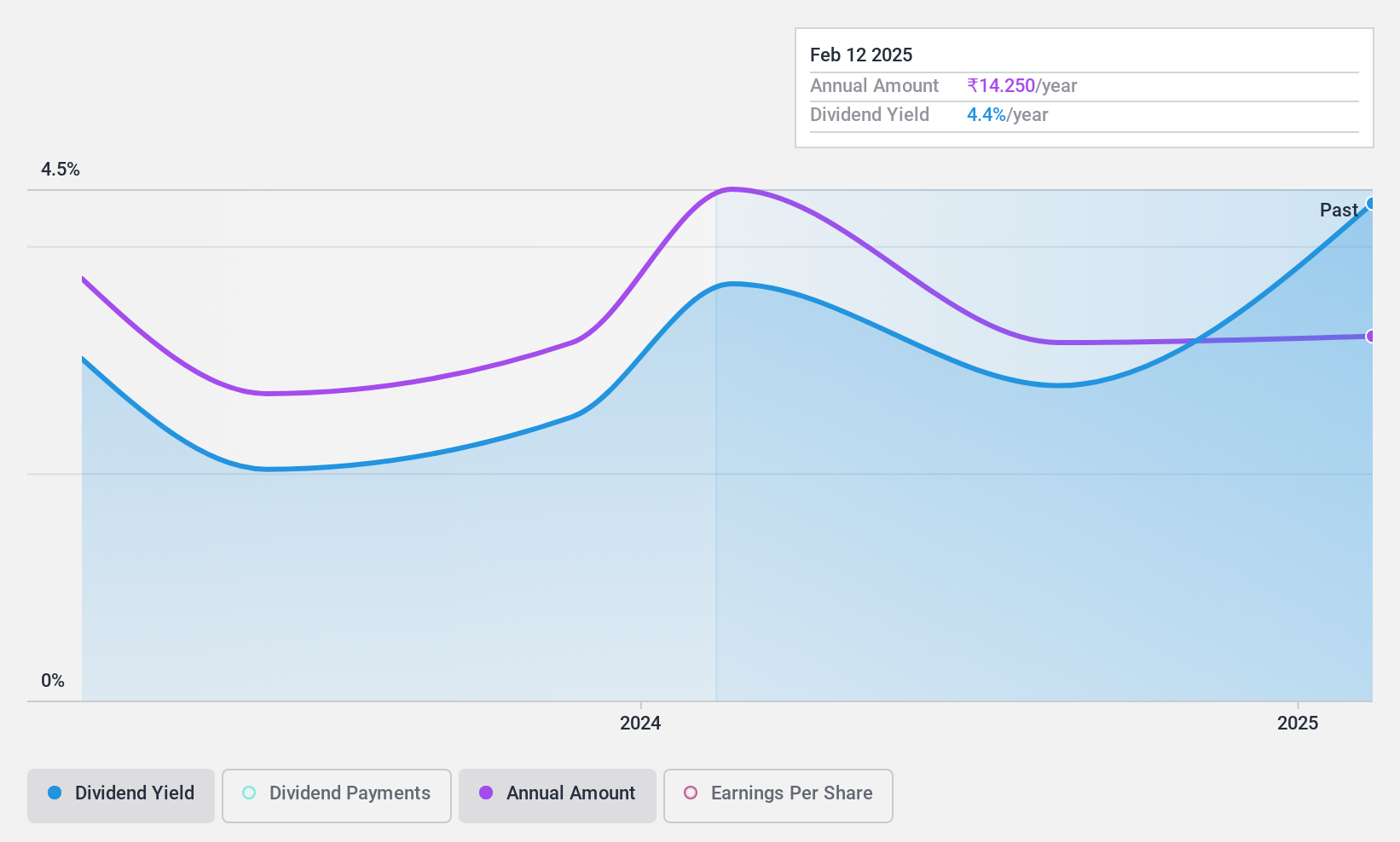

Dividend Yield: 4.5%

Uniparts India's dividend yield of 4.55% places it in the top 25% of Indian dividend payers, supported by a payout ratio of 73.8% and cash flow coverage at 56.7%. However, its short dividend history has been marked by volatility, with payments fluctuating over the past two years. Recent AGM announcements confirmed interim dividends totaling ₹14 per share for FY2024-25, reflecting management's commitment to returning value despite inconsistent earnings performance.

- Click here and access our complete dividend analysis report to understand the dynamics of Uniparts India.

- Our comprehensive valuation report raises the possibility that Uniparts India is priced lower than what may be justified by its financials.

Next Steps

- Investigate our full lineup of 19 Top Indian Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:UNIPARTS

Uniparts India

Manufactures and sells engineering systems, solutions, and assemblies primarily for off-highway vehicles in India, the United States, the Asia Pacific, Europe, Japan, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion