- India

- /

- Paper and Forestry Products

- /

- NSEI:GREENPLY

Why Investors Shouldn't Be Surprised By Greenply Industries Limited's (NSE:GREENPLY) 30% Share Price Surge

Despite an already strong run, Greenply Industries Limited (NSE:GREENPLY) shares have been powering on, with a gain of 30% in the last thirty days. The last month tops off a massive increase of 137% in the last year.

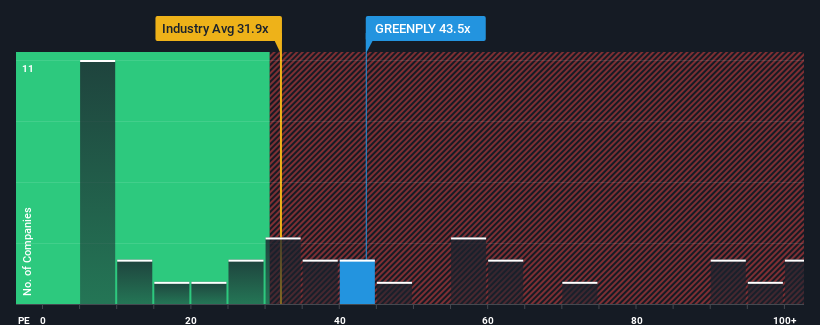

Following the firm bounce in price, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 33x, you may consider Greenply Industries as a stock to potentially avoid with its 43.5x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Greenply Industries as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Greenply Industries

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Greenply Industries would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 53% last year. Pleasingly, EPS has also lifted 46% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 28% per year during the coming three years according to the eleven analysts following the company. With the market only predicted to deliver 20% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Greenply Industries' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The large bounce in Greenply Industries' shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Greenply Industries' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Greenply Industries that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GREENPLY

Greenply Industries

An interior infrastructure company, engages in the manufacture and trading of plywood and allied products in India and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives