- India

- /

- Metals and Mining

- /

- NSEI:GRAVITA

Is Now The Time To Put Gravita India (NSE:GRAVITA) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Gravita India (NSE:GRAVITA). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Gravita India

Gravita India's Improving Profits

Over the last three years, Gravita India has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Gravita India's EPS shot up from ₹20.60 to ₹29.72; a result that's bound to keep shareholders happy. That's a impressive gain of 44%.

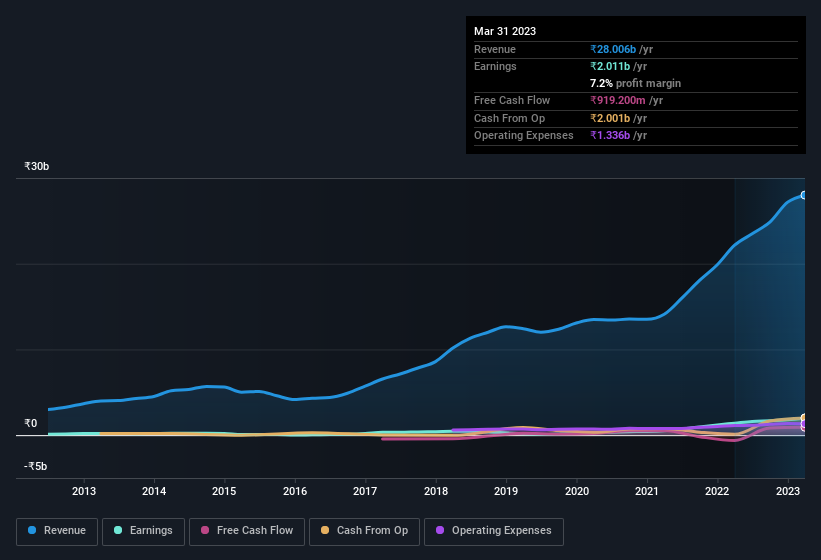

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While Gravita India did well to grow revenue over the last year, EBIT margins were dampened at the same time. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Gravita India Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Gravita India will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Indeed, with a collective holding of 79%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. This insider holding amounts to This is an incredible endorsement from them.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Gravita India with market caps between ₹17b and ₹66b is about ₹24m.

Gravita India offered total compensation worth ₹20m to its CEO in the year to March 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Gravita India To Your Watchlist?

You can't deny that Gravita India has grown its earnings per share at a very impressive rate. That's attractive. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. Everyone has their own preferences when it comes to investing but it definitely makes Gravita India look rather interesting indeed. What about risks? Every company has them, and we've spotted 2 warning signs for Gravita India you should know about.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GRAVITA

Gravita India

Manufactures and recycles lead metal, lead products, aluminium alloys, and plastic granules in India, the United Arab Emirates, South Korea, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.