Fine Organic Industries (NSE:FINEORG) Might Become A Compounding Machine

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, the ROCE of Fine Organic Industries (NSE:FINEORG) looks attractive right now, so lets see what the trend of returns can tell us.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Fine Organic Industries:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.46 = ₹7.1b ÷ (₹18b - ₹2.6b) (Based on the trailing twelve months to June 2023).

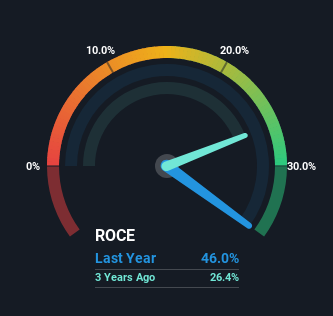

Therefore, Fine Organic Industries has an ROCE of 46%. That's a fantastic return and not only that, it outpaces the average of 14% earned by companies in a similar industry.

View our latest analysis for Fine Organic Industries

Above you can see how the current ROCE for Fine Organic Industries compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Fine Organic Industries.

What Does the ROCE Trend For Fine Organic Industries Tell Us?

We'd be pretty happy with returns on capital like Fine Organic Industries. Over the past five years, ROCE has remained relatively flat at around 46% and the business has deployed 290% more capital into its operations. With returns that high, it's great that the business can continually reinvest its money at such appealing rates of return. You'll see this when looking at well operated businesses or favorable business models.

On a side note, Fine Organic Industries has done well to reduce current liabilities to 15% of total assets over the last five years. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

In Conclusion...

In summary, we're delighted to see that Fine Organic Industries has been compounding returns by reinvesting at consistently high rates of return, as these are common traits of a multi-bagger. On top of that, the stock has rewarded shareholders with a remarkable 379% return to those who've held over the last five years. So while the positive underlying trends may be accounted for by investors, we still think this stock is worth looking into further.

If you'd like to know about the risks facing Fine Organic Industries, we've discovered 1 warning sign that you should be aware of.

Fine Organic Industries is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

If you're looking to trade Fine Organic Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FINEORG

Fine Organic Industries

Engages in manufacture, processing, supply, distribution, dealing, import, and export of oleochemical-based additives in India and internationally.

Flawless balance sheet with acceptable track record.