Is Now The Time To Put Fineotex Chemical (NSE:FCL) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Fineotex Chemical (NSE:FCL). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Fineotex Chemical

How Quickly Is Fineotex Chemical Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Fineotex Chemical has grown EPS by 39% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

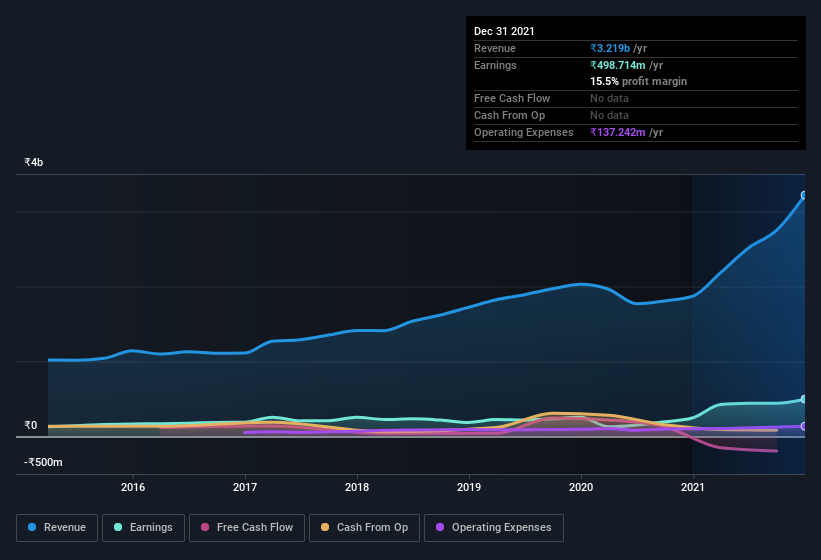

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Fineotex Chemical's EBIT margins were flat over the last year, revenue grew by a solid 72% to ₹3.2b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fineotex Chemical isn't a huge company, given its market capitalization of ₹16b. That makes it extra important to check on its balance sheet strength.

Are Fineotex Chemical Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Fineotex Chemical insiders spent ₹6.3m on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident. We also note that it was the CFO & Executive Director, Sanjay Tibrewala, who made the biggest single acquisition, paying ₹4.6m for shares at about ₹65.89 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Fineotex Chemical insiders own more than a third of the company. In fact, they own 62% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have ₹9.8b invested in the business, using the current share price. That's nothing to sneeze at!

Is Fineotex Chemical Worth Keeping An Eye On?

Fineotex Chemical's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Fineotex Chemical belongs on the top of your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Fineotex Chemical , and understanding these should be part of your investment process.

As a growth investor I do like to see insider buying. But Fineotex Chemical isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FCL

Fineotex Chemical

Engages in manufactures and sells textile chemicals, and auxiliary and specialty chemicals in India.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives