Clean Science and Technology Limited (NSE:CLEAN) Just Missed Earnings: Here's What Analysts Think Will Happen Next

Clean Science and Technology Limited (NSE:CLEAN) just released its latest quarterly report and things are not looking great. Earnings fell badly short of analyst estimates, with ₹2.2b revenues missing by 11%, and statutory earnings per share (EPS) of ₹6.20 falling short of forecasts by some -12%. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Clean Science and Technology

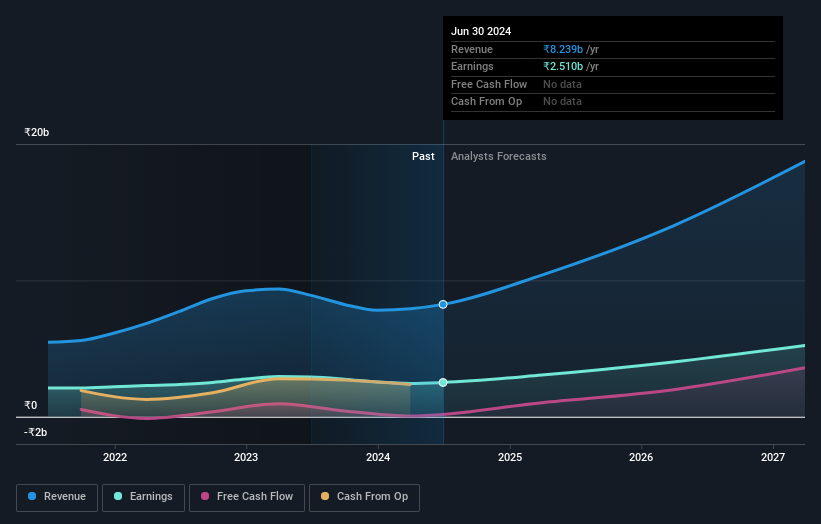

After the latest results, the ten analysts covering Clean Science and Technology are now predicting revenues of ₹10.4b in 2025. If met, this would reflect a substantial 26% improvement in revenue compared to the last 12 months. Per-share earnings are expected to shoot up 23% to ₹29.06. Before this earnings report, the analysts had been forecasting revenues of ₹10.8b and earnings per share (EPS) of ₹30.14 in 2025. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a small dip in earnings per share estimates.

The average price target climbed 8.3% to ₹1,568despite the reduced earnings forecasts, suggesting that this earnings impact could be a positive for the stock, once it passes. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Clean Science and Technology at ₹1,765 per share, while the most bearish prices it at ₹1,067. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Clean Science and Technology's rate of growth is expected to accelerate meaningfully, with the forecast 36% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 12% p.a. over the past three years. Compare this with other companies in the same industry, which are forecast to grow their revenue 12% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Clean Science and Technology is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on Clean Science and Technology. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Clean Science and Technology going out to 2027, and you can see them free on our platform here..

We don't want to rain on the parade too much, but we did also find 1 warning sign for Clean Science and Technology that you need to be mindful of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CLEAN

Clean Science and Technology

Manufactures fine and specialty chemicals in India, China, the Americas, Europe, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026