Here's Why Castrol India's (NSE:CASTROLIND) Statutory Earnings Are Arguably Too Conservative

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether Castrol India's (NSE:CASTROLIND) statutory profits are a good guide to its underlying earnings.

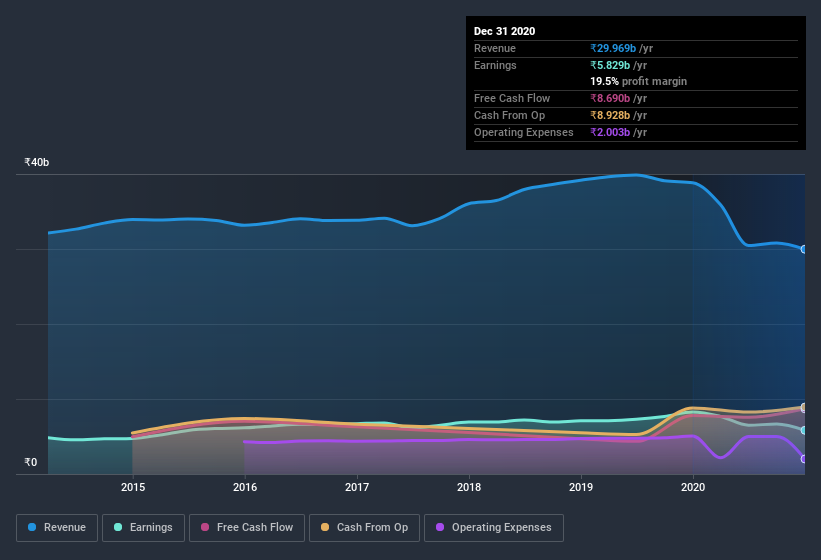

While Castrol India was able to generate revenue of ₹30.0b in the last twelve months, we think its profit result of ₹5.83b was more important. In the last few years both its revenue and its profit have fallen, as you can see in the chart below.

View our latest analysis for Castrol India

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. Today, we'll discuss Castrol India's free cashflow relative to its earnings, and consider what that tells us about the company. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Castrol India.

Examining Cashflow Against Castrol India's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Over the twelve months to December 2020, Castrol India recorded an accrual ratio of -0.99. Therefore, its statutory earnings were very significantly less than its free cashflow. Indeed, in the last twelve months it reported free cash flow of ₹8.7b, well over the ₹5.83b it reported in profit. Castrol India shareholders are no doubt pleased that free cash flow improved over the last twelve months.

Our Take On Castrol India's Profit Performance

Happily for shareholders, Castrol India produced plenty of free cash flow to back up its statutory profit numbers. Because of this, we think Castrol India's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! Unfortunately, though, its earnings per share actually fell back over the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example, we've discovered 1 warning sign that you should run your eye over to get a better picture of Castrol India.

Today we've zoomed in on a single data point to better understand the nature of Castrol India's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Castrol India or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:CASTROLIND

Castrol India

Manufactures and markets automotive and industrial lubricants in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives