The Camlin Fine Sciences (NSE:CAMLINFINE) Share Price Is Up 49% And Shareholders Are Holding On

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. For example, the Camlin Fine Sciences Limited (NSE:CAMLINFINE) share price is up 49% in the last year, clearly besting the market return of around 0.9% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! However, the stock hasn't done so well in the longer term, with the stock only up 11% in three years.

Check out our latest analysis for Camlin Fine Sciences

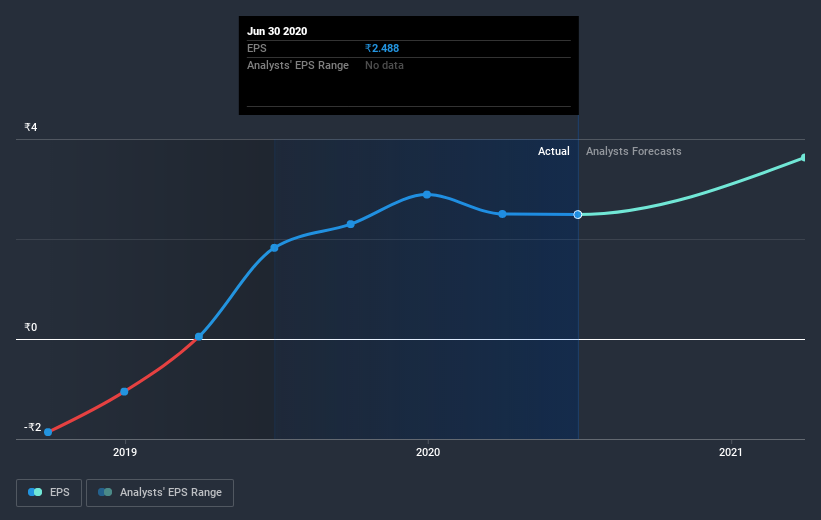

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Camlin Fine Sciences grew its earnings per share (EPS) by 36%. This EPS growth is significantly lower than the 49% increase in the share price. This indicates that the market is now more optimistic about the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Camlin Fine Sciences has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Camlin Fine Sciences' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Camlin Fine Sciences shareholders have received a total shareholder return of 49% over the last year. Notably the five-year annualised TSR loss of 3% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Camlin Fine Sciences (2 are concerning) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Camlin Fine Sciences, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:CAMLINFINE

Camlin Fine Sciences

Engages in the research, development, manufacture, and marketing of specialty chemicals, ingredients, and additive blend products in India and internationally.

Good value with mediocre balance sheet.