- India

- /

- Basic Materials

- /

- NSEI:BIRLACORPN

Here's Why Birla Corporation Limited's (NSE:BIRLACORPN) CEO Compensation Is The Least Of Shareholders' Concerns

Key Insights

- Birla will host its Annual General Meeting on 15th of September

- Salary of ₹17.5m is part of CEO Sandip Ghose's total remuneration

- The overall pay is comparable to the industry average

- Birla's EPS grew by 6.2% over the past three years while total shareholder return over the past three years was 22%

CEO Sandip Ghose has done a decent job of delivering relatively good performance at Birla Corporation Limited (NSE:BIRLACORPN) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 15th of September. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for Birla

How Does Total Compensation For Sandip Ghose Compare With Other Companies In The Industry?

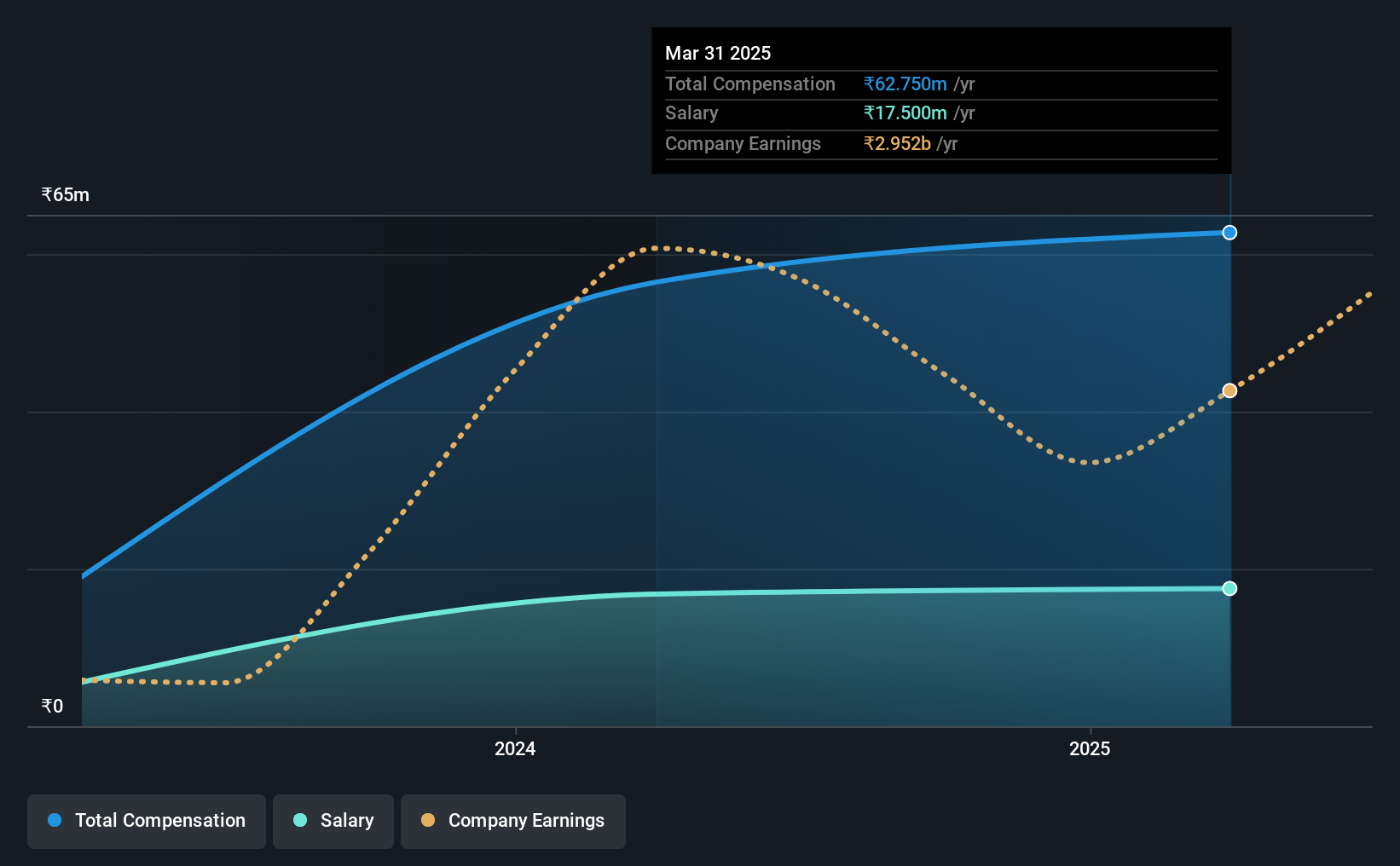

According to our data, Birla Corporation Limited has a market capitalization of ₹100b, and paid its CEO total annual compensation worth ₹63m over the year to March 2025. Notably, that's an increase of 11% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at ₹18m.

On comparing similar companies from the Indian Basic Materials industry with market caps ranging from ₹35b to ₹141b, we found that the median CEO total compensation was ₹63m. So it looks like Birla compensates Sandip Ghose in line with the median for the industry. Furthermore, Sandip Ghose directly owns ₹648k worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹18m | ₹17m | 28% |

| Other | ₹45m | ₹40m | 72% |

| Total Compensation | ₹63m | ₹56m | 100% |

Talking in terms of the industry, salary represented approximately 91% of total compensation out of all the companies we analyzed, while other remuneration made up 9% of the pie. Birla sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Birla Corporation Limited's Growth Numbers

Birla Corporation Limited's earnings per share (EPS) grew 6.2% per year over the last three years. The trailing twelve months of revenue was pretty much the same as the prior period.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but it is good to see modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Birla Corporation Limited Been A Good Investment?

Birla Corporation Limited has generated a total shareholder return of 22% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 1 warning sign for Birla that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Birla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BIRLACORPN

Birla

Manufactures and sells cement and clinker in India and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives